TS Intermediate Accountancy Deleted Syllabus 2026 Check Chapter Wise Syllabus

Table of Contents

- What is the Precise TS Intermediate Accountancy Deleted Syllabus 2026?

- How to Obtain the TS Intermediate Accountancy Syllabus 2026 PDF?

- What is the Exact TS Intermediate Accountancy Question Paper Pattern 2026?

- What is the Accurate TS Intermediate Accountancy Topics Weightage 2026?

- What are the Benefits of the TS Intermediate Accountancy Deleted Syllabus 2026?

The TSBIE (Telangana State Board of Intermediate Education) has the authority to make amendments to the 12th-class syllabus in the state. The decision to go ahead with the TS Intermediate accountancy Deleted Syllabus is commendable. Several significant changes have been made to revise the syllabus. It is a good initiative for restructuring the curriculum. Thus, if you are preparing for the TS Intermediate Exam 2026 then make sure to follow the updated syllabus pattern.

The TS Intermediate Deleted Syllabus will definitely help you to save a lot of time. Your anxiety level will come down and more attention can be paid to the fundamental topics. A lot of too-advanced and repetitive topics have been eliminated from the syllabus. The idea is to promote practical understanding in the field of accountancy. Various topics and subtopics in chapters such as bills of exchange, consignment accounts, NPO accounts, company accounts, etc. have been eradicated. Now, with the help of the TS Intermediate accountancy Deleted Syllabus, you can make a rational as well as effective study plan.

This article will help you to analyze the TS Intermediate accountancy Deleted Syllabus in an in-depth way. Hence, make sure to follow the information shared below.

What is the Precise TS Intermediate Accountancy Deleted Syllabus 2026?

The decision to apply the TS Intermediate accountancy Deleted Syllabus has been taken to diminish the workload of students. Thus, you should use this opportunity to improve your marks in the subject of accountancy. Having full knowledge about the deleted syllabus will help you a lot. The following table shares the chapter-wise deleted topics for TS Intermediate Accountancy -

|

Chapters |

Deleted Topics |

|

Bills of Exchange |

Accommodation Bill, Renewal of Bills, Insolvency of Acceptor – Portion shortened |

|

Consignment Accounts |

Valuation of Unsold Stock in Transit – Topic has been simplified |

|

Non-Profit Organization |

Preparation of Receipts and Payments Account – Details have been cut short |

|

Partnership Accounts |

Past Adjustments and Guarantee of Profit – Topics have been simplified |

|

Company Accounts |

Issue of Debentures, Redemption of Debentures – Some portions have been eradicated |

|

Computerized Accounting |

Detailed theoretical portion on software types and their comparison has been removed |

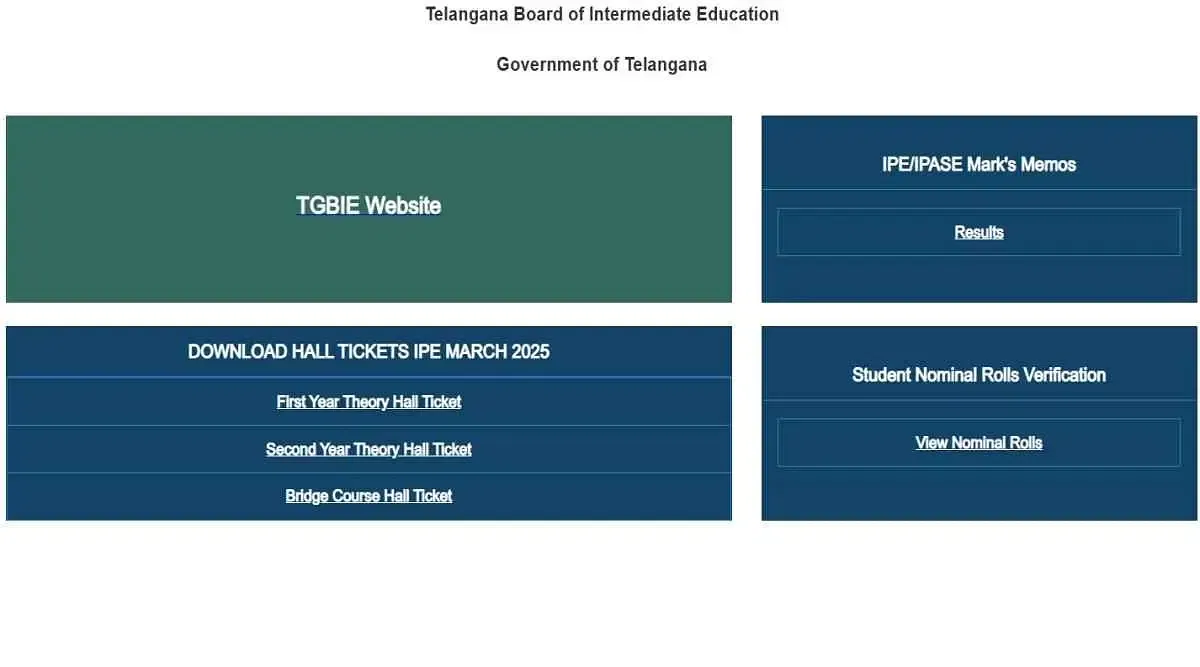

Also Read: TS Intermediate Admit Card

How to Obtain the TS Intermediate Accountancy Syllabus 2026 PDF?

When you are making a study plan for Accountancy then always keep an updated syllabus by your side. Don’t try to solve the questions from the deleted syllabus. It will just be a waste of time. The table here shares the updated PDF for the TS Intermediate Accountancy syllabus -

|

TS Intermediate Accountancy Syllabus 2026 – Download PDF |

Also Read: TS Intermediate Previous Year Question Papers

What is the Exact TS Intermediate Accountancy Question Paper Pattern 2026?

The TS Intermediate Accountancy question paper in total will carry 100 marks. The paper will be divided into Part 1 and Part 2 (each part will carry a weightage of 50 marks). There will be three sections in Part 1 (A, B, and C). There will be four sections in Part 2 (D, E, F, and G). The Accountancy paper will be a mix of long, short, and detailed kind of questions. The table underneath with help you to comprehend the exact TS Intermediate Accountancy question paper pattern -

|

Sections in Part 1 |

Number of Questions |

Marks Allotted |

|

A |

2 (long-answer-type questions) |

2 x 10 = 20 |

|

B |

4 (short-answer-type questions) |

4 x 5 = 20 |

|

C |

5 (very short-answer-type questions) |

5 x 2 = 10 |

|

Total |

|

50 Marks |

|

Sections in Part 2 |

Number of Questions |

Marks Allotted |

|

D |

1 (very long-answer-type question) |

1x 20 = 20 |

|

E |

1 (long-answer-type question) |

1 x 10 = 10 |

|

F |

2 (short-answer-type questions) |

2 x 5 = 10 |

|

G |

5 (very short-answer-type questions) |

5 x 2 = 10 |

|

Total |

|

50 Marks |

|

Aggregate of sections A, B, C, D, E, F, and G in Part 1 and Part 2 |

|

100 Marks |

Also Read: TS Intermediate Sample Papers

What is the Accurate TS Intermediate Accountancy Topics Weightage 2026?

The table underneath with help you to comprehend the TS Intermediate Accountancy topics and their weightage in the exam:

|

Topics |

Weightage |

|

Partnership Accounts |

25% |

|

Company Accounts |

20% |

|

Financial Statements |

15% |

|

Consignment and Joint Venture |

10% |

|

Depreciation and Provisions |

10% |

|

Rectification of Errors |

5% |

|

Non-Profit Organization |

5% |

|

Bills of Exchange |

5% |

|

Computerized Accounting System, Other Miscellaneous Topics |

5% |

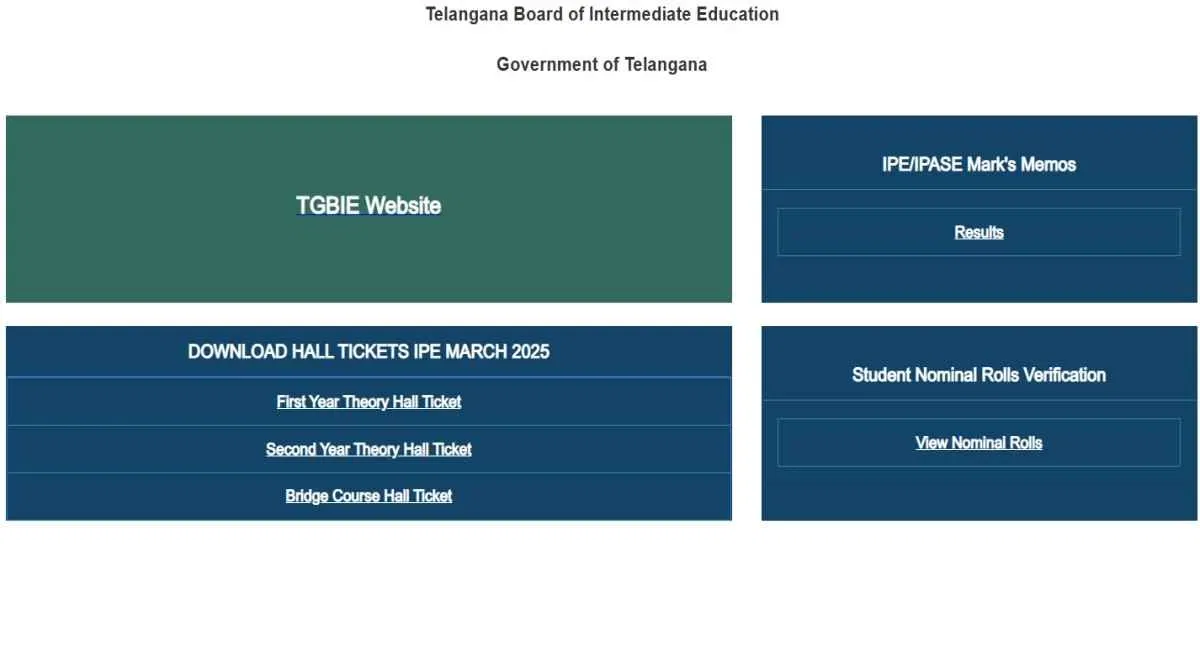

You must understand the fact that the percentages reflected in the table above are the approximate values based on the Accountancy syllabus pattern. If you need the most up-to-date information about the weightage, updated syllabus, or deleted syllabus, visit the website of the board at tgbie.cgg.gov.in.

Also Read: TS Intermediate Exam Preparation Tips

What are the Benefits of the TS Intermediate Accountancy Deleted Syllabus 2026?

There are many crucial benefits of the TS Intermediate accountancy Deleted Syllabus. Some of the key advantages have been discussed below –

-

The TS Intermediate accountancy Deleted Syllabus will help you to create a smart study plan. It will rationalize your academic journey for sure.

-

Because of the reduced syllabus, you will get more time to focus on the most fundamental chapters in Accountancy. Thus, your conceptual knowledge will also be enhanced.

-

You will get more time for practice and revision. This will boost the confidence level.

-

The deleted syllabus offers a good opportunity to get excellent marks in the subject of Accountancy.

-

You will feel less academic pressure because of the decreased syllabus.

-

While practicing from the previous years’ Accounts question papers and sample papers, you can leave out the questions that belong to the deleted syllabus.

To get more useful updates about the TS Intermediate Exam, make sure to follow Getmyuni!