BAF: Full Form, Course Details, Fees, Colleges, Admission, Duration

BAF is a three-year undergraduate course that deals with the study of core accounting principles, finance, economics, and topics related to various functionalities of the commerce field. A Bachelor of Accounting and Finance is a degree program that combines the study of accounting principles and financial management.

BAF admission requires candidates to have a 50% aggregate in Higher Secondary (10+2) with commerce stream and qualifying entrance exams such as MH-CET, CUET, etc. The BAF course fees per year range between INR 16,000-1,00,000. The core subjects under the BAF syllabus include Financial Accounting, Managerial Accounting, Corporate Finance, Business Law and Ethics, Investment Analysis, etc.

Students receive industry-relevant training and exposure to work in banks, financial institutions, audit firms, and actuarial services as auditors, accountants, export or import managers, tax consultants, etc.

Table of Contents

- What is BAF Course?

- BAF Eligibility Criteria

- Why Choose the Bachelor of Accounting and Finance Course?

- BAF Admission Process

- BAF Entrance Exams

- Top Bachelor of Accounting and Finance Colleges in India

- Types of BAF Courses

- BAF Syllabus and Subjects

- BAF vs BCom

- Courses After BAF

- Career Options After Bachelor of Accounting and Finance

- BAF Salary in India

- Top Cities to Pursue BAF Course

- BAF Scholarships

- Skills to Excel as a BAF Graduate

BAF Course Details

| Degree | Bachelors |

| Full Form | Bachelor of Accounting and Finance |

| Duration | 3 Years |

| Age | Minimum age limit is 17 years |

| Subjects Required | Accounting, Mathematics, Economics |

| Minimum Percentage | 50% marks in 10+2 examinations. |

| Average Fees | INR 16,000-1,00,000 Per Year |

| Similar Options of Study | B.Com, BBA |

| Average Salary | INR 2-6 LPA (Source: PayScale) |

| Employment Roles | Auditor, Accountant, Export or Import Manager, Tax Consultant, Stockbroker, etc. |

| Top Recruiters | EY, KPMG, Deloitte, PWC, Accenture, Oracle, Gartner, SBI, etc. |

What is BAF Course?

BAF full form is Bachelor of Accounting and Finance, a course designed to impart the necessary knowledge on the core functionalities of commerce, including several topics such as accounting, finance, taxation, auditing, and risk management.

After completion of the BAF course, students can pursue rewarding careers with actuarial firms, banking, business analysis, financial management, actuarial service, e-commerce, financial analysis, etc. The average BAF graduate salary is in the range of INR 2-6 LPA. (Sources: Ambition Box & Glassdoor).

BAF Eligibility Criteria

For BAF admission, students must meet the BAF eligibility set by a specific university/college such as minimum percentage, subject required, entrance exam score, etc. The standard eligibility criteria is listed below:

- Students must have completed a 10+2 degree in Commerce or a related stream with a minimum of 50% marks for the general category and 45% marks for reserved category students. Students are also required to clear entrance exams like MHT-CET, CUET, etc.

- The minimum age limit to enroll in the course is 17 years.

Why Choose the Bachelor of Accounting and Finance Course?

BAF course offers a strong foundation and expertise in the area of financial analysis, auditing, and budgeting required for a successful career. Below mentioned are points regarding why choose the BAF course:

- India has a broad financial industry that is rapidly growing due to both the expansion of already-existing financial services companies and the entry of new market players.

- According to the Hindustan Times, India's fintech market is projected to reach $150 billion by 2025, making it one of the nations with the fastest growth rate.

- According to Business Today, the banking and financial sector generated 67,000 new jobs in FY22.

- Students have the opportunity to work at several companies like EY, KPMG, Deloitte, PWC, Accenture, Oracle, Gartner, SBI, etc.

Also, Compare: BBA vs BAF

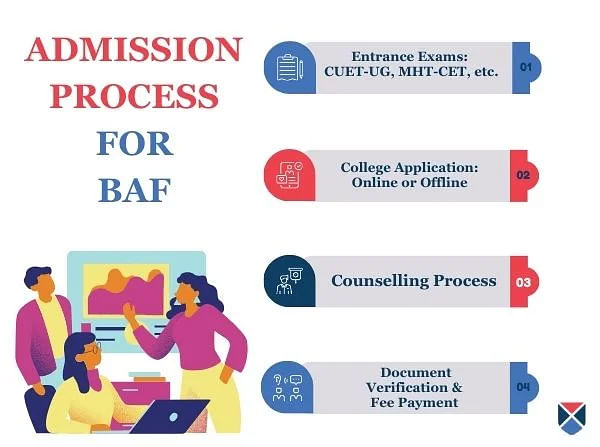

BAF Admission Process

BAF admission is based on merit basis in colleges like KES, MSG SGKM College of Arts, Science and Commerce. Colleges like Jai Hind may conduct entrance exams for the course based on the requirement. In general, the admission process includes the following components:

- Step 1: The candidate should clear the cut-off marks in the entrance exams as required by the colleges.

- Step 2: Further, the candidate should fill out the application forms of respective colleges available either online or offline.

- Step 3: The official website of a university will release a selection list based on merit or entrance examination.

- Step 4: After appearing for counseling, students must submit all the necessary documents and pay the fees.

BAF Entrance Exams

Some colleges and universities offer a Bachelor of Finance and Accounting, through national, state, or college-level entrance exams. There may be differences between university/ college entrance exams and cutoff marks. Here are some of the most popular BAF entrance exams:

|

Entrance Exam |

Registration Dates |

Accepting Colleges |

|

Jan 16-Mar 1, 2024 |

Jai Hind College |

|

|

February 2024-April 2024 ( Tentative) |

St. Xaviers College |

Top Bachelor of Accounting and Finance Colleges in India

There are various government and private colleges in India offering BAF courses. Top private colleges offering BAF courses include HB Institute of Communication and Management, Jai Hind College, etc. Government colleges like Shankar Narayan College also offer B.A.F courses. The BAF fees per year is in the range of INR 16,000-1,00,000. Below is a list of top BAF colleges in India along with the annual fees:

|

Institution |

Annual BAF Fee |

|

INR 21,449 |

|

|

INR 16,731 |

|

|

INR 55,000 |

|

|

INR 35,000 |

|

|

INR 70,000 |

|

|

INR 23,000 |

|

|

- |

|

|

- |

|

|

ML Dahanukar College of Commerce |

INR 19,079 |

|

Shri GPM College |

INR 17,500 |

|

Vivek College of Commerce |

INR 18,234 |

|

Anna Leela College of Commerce and Economics |

INR 28,400 |

|

Shankar Narayan College |

INR 18,423 |

|

NM College |

INR 38,990 |

|

BNN College |

- |

Types of BAF Courses

The course has full-time and distance learning options available to students. The following BAF course details are provided below:

|

Type |

BAF Eligibility |

BAF Duration |

|

BAF Full Time |

Should have passed 10+2 with a minimum of 50% marks + Entrance Exam |

3 Years |

|

Distance BAF |

Should have passed 10+2 with a minimum of 45-50% marks. |

3-5 Years |

Distance BAF Course

Below mentioned are details regarding the distance BAF course:

- The distance BAF course can be pursued from various colleges like IMTS Institute, Directorate of Distance Education, etc.

- The annual distance BAF fees is in the range of INR 20,000-50,000.

- There is no upper age limit to enroll in the course.

- The course duration can be extended to a maximum of five years depending on the coursework completed by the student.

Also, Check:

| Diploma in Accounting and Finance | B.Com Accounting and Finance |

BAF Syllabus and Subjects

The BAF syllabus focuses on imparting the necessary knowledge and abilities to evaluate financial figures and efficiently manage financial resources along with recent cost accounting techniques in accounting and current taxation issues. The syllabus for the BAF course is given below:

|

Semester I |

Semester II |

|

Foundational Cost Accounting-I |

Business Communication-II |

|

Business Environment |

Special Accounting Areas- I |

|

Micro Economics |

Financial Accounting-II |

|

Foundation Course-I (Commercial Environment) |

Business Regulatory Framework- I |

|

Financial Accounting-I |

Indirect Taxation-I |

|

Business Communication-I |

Quantitative Methods for Business-I |

|

Semester III |

Semester IV |

|

Macro Economics |

Special Accounting Areas-III |

|

Methods of Cost Accounting-II |

Financial Market Operations |

|

Techniques of Auditing and Audit Procedures |

Information Technology Application in Business |

|

Special Accounting Areas-II |

Indirect Taxation-II |

|

Business Regulatory Framework-II |

Foundation Course -II (Value Education and Soft Skill) |

|

Introduction to Management |

Company Law |

|

Quantitative Methods for Business-II |

Financial Accounting-IV |

|

Semester V |

Semester VI |

|

Financial Accounting -V |

Financial Accounting -VII |

|

Cost Accounting-III |

Cost Accounting – IV |

|

Financial Statement Analysis |

Financial Accounting – VIII |

|

Direct & Indirect Taxation – III |

Direct & Indirect Taxation- IV |

|

Indian Economy System |

Elective-II |

|

Project Work |

Internship/Project Work-II |

|

Financial Accounting-VI |

|

|

Elective-I |

- |

Read More: BAF Subjects and Syllabus

BAF vs BCom

BAF focuses on accounting, finance, and business management, whereas, BCom (Bachelor of Commerce) programs provide students with a strong foundation in financial management, auditing, and taxation. The table below represents the difference between BAF and BCom:

|

Course |

BAF |

BCom |

|

Full-Form |

Bachelor of Accounting and Finance |

Bachelor of Commerce |

|

Course Duration |

3 years |

3 years |

|

Course Overview |

The course curriculum covers subjects like financial analysis, financial reporting, taxation, etc. |

The course curriculum focuses on subjects like accounting, economics, business law, taxation, and business communication. |

|

Eligibility |

50% in 10+2, with Commerce |

12th pass in commerce with a minimum of 50% marks. |

|

Course Fee Per Year |

INR 16,000-1,00,000 |

INR 7,500-4,00,000 |

|

Entrance Exam |

MHT-CET, CUET |

SUAT, BHU UET, AIMA UGAT |

|

Top Colleges |

St. Xaviers College, Mumbai University |

Shri Ram College of Commerce, BML Munjal University, St. Xaviers College. |

|

Average Salary |

INR 2-6 LPA |

INR 4 LPA |

|

Job Roles |

Financial Analyst, Accountant, Credit Analyst, Investment Analyst, Tax Consultant, etc. |

Accountant, Cost Estimator, Financial Analyst, etc. |

Read More: BCom

Courses After BAF

After completing the BAF course, students can pursue several higher education studies that can improve their understanding of the subjects. Below mentioned are a few courses that can be pursued after BAF:

- MBA in Finance

- MFM

- CFA

- CA

- CS

- MBA in Cost and Management Accounting

- M.Com in Accounting and Finance

- M.Com in Accounting and Taxation

- PGDip in Professional Accounting

- M.Com in Finance

Career Options After Bachelor of Accounting and Finance

BAF course allows students to increase their employability by adding to their qualifications. Various colleges provide BAF placement to students and help them shape their careers in the right direction.

Some of the job opportunities that students can get after completing BAF are mentioned below:

|

BAF Jobs |

Job Description |

Top Hiring Companies |

|

Financial Analyst |

|

Deloitte, KPMG, EY, PwC, HDFC Bank, ICICI Bank, etc. |

|

Accountant |

Managing financial records, preparing budgets, and ensuring compliance with accounting standards. |

Infosys, Accenture, Hindustan Unilever, State Bank of India (SBI), etc. |

|

Credit Analyst |

|

Axis Bank, HDFC Bank, ICICI Bank, Bajaj Finance, etc. |

|

Investment Analyst |

|

Kotak Mahindra Asset Management, Birla Sun Life Mutual Fund, etc. |

|

Tax Consultant |

|

Ernst & Young (EY), Deloitte, KPMG, etc. |

|

Auditor |

|

Ernst & Young (EY), Deloitte, KPMG, PwC, etc. |

|

Treasury Analyst |

|

Reliance Industries, Tata Consultancy Services (TCS), State Bank of India (SBI), etc. |

|

Financial Planner/Advisor |

Guiding people or businesses to reach their financial objectives by offering planning, investment strategies, and financial advice. |

Axis Bank, Bajaj Allianz, SBI Life Insurance, Kotak Mahindra Life Insurance, etc. |

|

Risk Analyst |

|

ICICI Bank, HDFC Bank, Axis Bank, Standard Chartered, Kotak Mahindra Bank, etc. |

|

Corporate Finance Analyst |

|

Tata Steel, Aditya Birla Group, Mahindra & Mahindra, Larsen & Toubro, etc. |

Read More: BAF Job Opportunities and Scope

BAF Salary in India

Graduates with a BAF can expect to earn INR 2-6 LPA (Sources: Glassdoor & Ambition Box). Students are paid based on their skills and experience, as well as on the progress they have made. Graduates after a BAF degree are in greater demand due to continuous growth in the financial sector.

|

BAF Jobs |

Entry Level Average Salary (INR) |

Salary After 3 Years of Experience (INR) |

|

Financial Analyst |

3.5 LPA |

6.5 LPA |

|

Accountant |

2.5 LPA |

5 LPA |

|

Credit Analyst |

3-4 LPA |

7 LPA |

|

Investment Analyst |

4-4.5 LPA |

7.5 LPA |

|

Tax Consultant |

3-4 LPA |

5.5-7 LPA |

|

Auditor |

3-3.5 LPA |

4-6 LPA |

|

Treasury Analyst |

3-4 LPA |

5-6.5 LPA |

|

Financial Planner/Advisor |

2.5-3.5 LPA |

6 LPA |

|

Risk Analyst |

3.5-4.5 LPA |

7 LPA |

|

Corporate Finance Analyst |

4-5 LPA |

5.5-7 LPA |

Read More: BAF Salary in India

Top Recruiters for BAF

Below listed are a few top recruiters for BAF graduates:

|

Deloitte |

Cognizant |

Concentrix |

|

Oracle |

Hexaware |

Birla Sun Life Insurance |

|

SBI |

IBM |

Mahindra Finance |

|

Gartner |

HDFC Bank |

Muthoot Finance |

|

TCS |

DNS Bank |

Serco |

Top Cities to Pursue BAF Course

Students can pursue a BAF course from top cities like Mumbai and Bangalore., in prominent colleges like Jai Hind College, St. Xaviers College, etc. Mumbai is considered a home to various top colleges offering BAF course.

Below listed are the top 2 cities to pursue BAF course based on approximate, and actual living expenses, salaries, market conditions, etc.

|

City |

Top Colleges Offering BAF Course |

Average Living Monthly Expenses (INR) |

Average Starting Salary (INR) |

Top Recruiters |

|

Mumbai |

St. Xaviers College, HR College of Commerce and Economics, Mumbai University, etc. |

15,000 - 25,000 |

3-5 LPA |

HDFC Bank, Kotak Mahindra Bank, etc. |

|

Bangalore |

CMR National PU College, St. Joseph's College of Commerce |

12,000 - 20,000 |

INR 3.50-4 LPA |

Infosys, Wipro, etc. |

BAF Scholarships

There are various scholarships offered to students who want to pursue BAF courses by government and private institutes based on annual income, merit score, quota, etc. Below listed are a few scholarships for BAF course:

|

BAF Scholarship |

Eligibility Criteria |

Amount |

|

Raman Kant Munjal Scholarships |

|

Tuition Fee Waiver |

|

Kotak Junior Scholarship |

|

INR 3,000 Per Month |

Skills to Excel as a BAF Graduate

BAF graduates should possess analytical and critical thinking skills. Learning skills based on their interests can also influence a student's career. The following skills are expected of Bachelor of Accounting and Finance graduates:

- Financial Analysis: It is essential for assessing an organization's performance, forming wise choices, and pinpointing areas in need of development.

- Accounting Skills: For maintaining accurate financial records, ensuring compliance, and facilitating strategic planning.

- Data Analysis: It is essential for extracting insights, identifying trends, and making data-driven financial decisions.

- Risk Management: It helps identify, assess, and mitigate potential financial threats while safeguarding the stability of the organization.

- Communication Skills: It facilitates the efficient distribution of financial data to various stakeholders, promoting comprehension and well-informed decision-making.

Top BAF [Bachelor of Accounting and Finance] Colleges

BAF Fee Structure

FAQs on BAF

Q: What is BAF full form?

Q: Which is better BAF or BBA?

Q: Is BAF a good career option?

Q: Which are the best Bachelor of Finance and Accounting colleges in India?

Q: What are the core subjects in the BAF course?

Q: What is the scope of the BAF degree?

Q: What is the salary of a BAF graduate?

Q: Does BAF include Maths?

Q: What are the entrance exams required for the BAF course?

Q: Which is better, BAF or BCom?

Q: What is BAF fees in Mumbai?