CMA: Course Details, Eligibility, Fees, Admission

CMA or Cost Management Accounting, is a three-year certificate programme that focuses on financial understanding to ensure that organisations are proficient and profitable with meaningful financial data and analysis. The main aim of the CMA course is to prepare students for working in various enterprises and corporate capacities to deal with various management and financial related problems.

Table of Contents

- About CMA Course

- Eligibility Criteria for CMA

- Who Should Pursue a CMA Course?

- Admission Process for CMA

- Types of CMA Courses

- How To Get Exemption in CMA

- Popular Entrance Exams for CMA

- Top CMA Colleges in India

- Fee Structure for CMA

- CMA Course Comparison

- Syllabus and Subjects for CMA

- Why Choose CMA Course?

- Preparation Tips For CMA Course

- Scope Of CMA For Higher Education

- Salary of a CMA Graduate

- Career Options After CMA

- Skills That Make You The Best CMA Graduate

CMA Course Details

| Degree | Certificate |

| Full Form | Cost Management Accounting |

| Duration | 3 Years |

| Age | Minimum 17 years |

| Minimum Percentage | 50% with commerce in HSC |

| Average Fees | ₹50K - 2.5 LPA |

| Average Salary | INR 2.5 LPA - 7 LPA (Source: Payscale) |

| Employment Roles | Chief Financial Officer, Chief Investment Officer, Cost Accountant, Cost Manager, Financial Analyst, Corporate Controller, Financial Controller. |

About CMA Course

CMA full form is Cost Management Accounting. CMA is a certification program that imparts candidates with expertise and knowledge in the field of Management and Executive level duties with regard to financial analysis, financial cost planning, cost analysis, etc. CMA course duration in India is two years.

CMA subjects include the study of fundamentals of business mathematics and statistics, laws and ethics, economics, accounting, and much more. CMA job scope is vast with employment opportunities in roles such as accountant, management consultant, financial analyst, financial controller, etc.

Eligibility Criteria for CMA

CMA eligibility criteria in India requires the aspirants to complete their 10+2 with a minimum of 50% aggregate marks with commerce from any recognized board of education. In addition to the basic essential CMA eligibility criteria, students pursuing the course must have passed the standard entrance examination with a good grade from any institute in order to be admitted.

The minimum age for applying for the CMA course is 17 years, which means that aspirants can apply once they have turned 17.

CMA Foundation Eligibility Criteria

Listed below are the CMA foundation eligibility criteria:

- Candidates need to pass the 10 or equivalent as well as the 12 or equivalent

- The candidates have received a national diploma in commerce or equivalent from either AICTE or any recognized board.

CMA Intermediate Eligibility Criteria

Listed below are some of the intermediate eligibility criteria:

- Students have to pass SSC or equivalent

- Students have to clear a foundation or entry-level common entrance test (CAT) by the Institute of Cost Accountants of India

- Students have to clear graduation in any stream (except Fine Arts )

- If students are expecting results will pass the CMA course eligibility

CMA Final Eligibility Criteria

Listed below are some of the CMA final eligibility criteria:

- Candidates who did their Intermediate level at school

- Students need to graduate in any stream (except Fine Arts)

- Students have to pass all eight intermediate papers

Who Should Pursue a CMA Course?

The goal of the CMA course, a certification programme, is to give candidates professional knowledge and training in the area of management accounting. Candidates should consider the following while choosing an MBA programme in project management: individuals who want to work in the accounting and management fields.

- Students who specialise in accounting and have completed their 10+2 requirements in any stream other than the arts.

- After working in the industry for at least a year, candidates can enrol in the course to sharpen and improve their account management skills.

When To Do CMA Course?

At the national and international levels, CMA programmes provide professional prospects in a wide range of industries. A few factors that affect MBA project management are the ones listed below:

- The optimum time to start is right after high school or even while you're still in high school.

- Take the last year of high school to simultaneously prepare for the CMA to ensure that you are exam-ready.

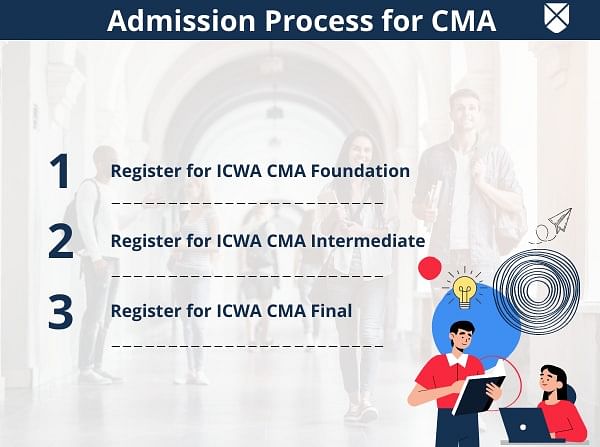

Admission Process for CMA

CMA Admission in India can be done in two distinct ways. It can either be done from the college or the university premises directly by approaching the admission office or online from the admission portal.

The admission process for the course is undertaken strictly based on the marks from the 10+2 classes in commerce with a minimum of 50 % aggregate marks. Therefore, the aspirants applying for the course must satisfy the CMA course essential criteria, including marks scored in their 10+2 classes and the entrance exams corresponding to CMA.

How to Apply?

Aspirants can either apply for the CMA course online or offline. Aspirants must visit the respective college or university's website, fill in relevant details in the form, and upload it along with the other required documents. For offline registration, the aspirant needs to directly visit the college or university, fill out the application form and submit the necessary documents at the college by hand.

After filling out and submitting the application form and other documents, the students will be invited by the college or university officials to appear for a written test followed by a personal interview, group discussion, and counselling.

Selection Process

Once the aspirants' application has been accepted at the college or the university admission portal, the college officials conduct counselling rounds, personal interviews, group discussions, and written tests, which are optional in some colleges and universities. candidates who complete the written test, personal interviews, and group discussions are allocated seats based on the qualification criteria of colleges/universities.

Types of CMA Courses

The course is competent for both undergraduate and postgraduate candidates. CMA course full form is the Cost Management Accounting course. Candidates who did their higher school from an Indian-recognized board qualified for the foundation course.

Candidates who completed their undergraduate studies can chase the intermediate level. Candidates should have to follow the final level of the course to evolve advanced abilities in cost management accounting.

- ICWA CMA Foundation rank is the course's first and most important mark. In this study phase, students are exposed to the basics of cost management strategies and a spot in the financial industry through this foundation stage. The CMA duration is approx 8 months.

- ICWA CMA Intermediate Stage is the second stage of the ICWA course. Candidates need to clear the intermediate course after successfully finishing the foundation level, and candidates will go through different aspects of financial accounting in-depth. Students are oriented into various financial topics such as direct and indirect taxation cost and accounting, and many more. The course might seem a little more difficult than the other one.

- ICWA CMA Final Stage is the course conclusion. In third, the course seems to be the most difficult of all three. In this stage, the course provides perspectives on various financial issues such as strategic financial management and particular regulations on various taxation.

How To Get Exemption in CMA

Students need to clear a group of CMA exams and are required 40% marks in each of the subjects of a group and with an aggregate of 50% or more in the group. Listed below are some of the rules in CMA exams in availing the benefits of exemption and with marks:

- Exemption in CMA Exams: If a student failed and couldn't clear a group of CMA exams but secured 60% marks or more in any particular paper, the student shall be exempted from appearing on that paper in the subsequent attempt. In the case of aggregate calculation, the marks in the exempted paper will be reckoned as 50% in the subsequent attempt.

- Carry Forward of Marks: If a student failed and didn't able to clear a group but secured 60% or more marks in a particular paper and 40% marks in other papers of that group, the student shall be exempted from appearing in that paper in subsequent. That benefit is moving forward of actual marks of exempted paper in the subsequent group.

Popular Entrance Exams for CMA

There are numerous entrance exams for the CMA course that students must take. Attendance at the entrance exams, as well as a good merit score from the 10+2 classes, are thus required to gain CMA admission. The following are some of the best and most required CMA entrance exams:

A Quick Glance At the CMA Entrance Exams

The eligibility criteria are dependent on the conducting body which curates the entrance exam questions that asses the quantitative knowledge, qualitative problem-solving skills and general knowledge. The examination includes:

- The entrance exams include various objective and multiple-choice type questions.

- The exam is conducted both online and offline, and the duration is 4 hours.

- The entrance exam assesses the student's financial reporting, Planning, Performance and Control, Strategic Financial Management, etc.

ICWAI CMA

ICWAI CMA courses are categorized into three parts for better understanding. Listed below are the three levels of course and duration:

- ICWA Foundation: Up to 8 months

- ICWA Intermediate: Up to 10 months

- ICWA Final: Up to 18 months

ICWA CMA Intermediate Entrance Examination

The Institute of Cost and Works Accountants of India (ICWAI) held the ICWA intermediate entrance examination to assess the credentials of students who completed the foundation course. After passing the admission exam, students must enrol in the intermediate course.

ICWA CMA Final Examination

ICWA's final examination is conducted by The Institute of Cost and Works Accountants of India (ICWAI) to judge the integrity of students' knowledge acquired across all three courses.

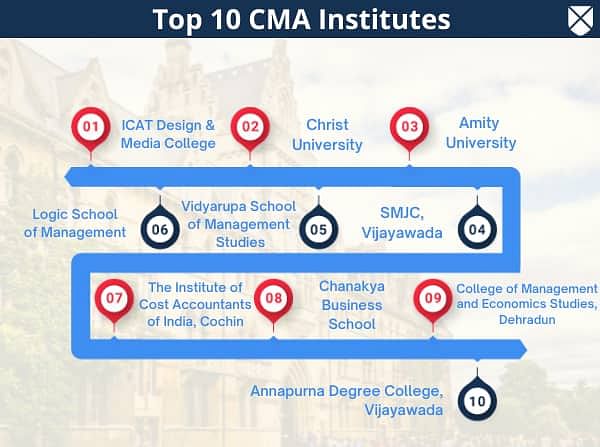

Top CMA Colleges in India

To become a Certified Management Accountant in India, aspirants must complete the ICWAI CMA courses and write the exams conducted by the Institute of Cost and Works Accountants of India (ICWAI). India is home to many premier institutes that offer ICWAI CMA courses.

Top CMA institutes in India and abroad offer a CMA degree course to students interested in learning a course related to cost and financial accounting. Some of the very best CMA colleges in India are as follows:

| Sl.No. | Name of the College |

| 1 | ICAT Design & Media College |

| 2 | Christ University |

| 3 | Amity University |

| 4 | SMJC, Vijayawada |

| 5 | Vidyarupa School of Management Studies |

| 6 | Logic School of Management |

| 7 | The Institute of Cost Accountants of India, Cochin |

| 8 | Chanakya Business School |

| 9 | College of Management and Economics Studies, Dehradun |

| 10 | Annapurna Modern Degree College, Vijayawada |

Fee Structure for CMA

CMA course fees in India range from INR 50,000 - 2.5 LPA. They may even differ depending on the college/facilities university and amenities, as well as the level of education provided to students. The CMA fee structure may differ depending on the college or university chosen by the students. The following are the CMA fees in India structure for colleges:

| College Name | Fees Per Annum (INR) |

| Lakshya Academy, Kochi | 25,000 |

| Amity University, Lucknow | 65,000 |

| Shobhit University, Meerut | 40,000 |

| Jain University Bangalore | 50,000 |

| BCMS, Bangalore | 1 LPA |

CMA Course Comparison

Below is a list of course comparison between ICWA CMA and Chartered Accountancy.

CMA vs CA

CMA and CA are accounting courses with a focus on one of the most important aspects of the commerce and finance industry. There are similarities and differences between the two courses; for a better understanding, the following points are highlighted in a tabular format.

| Criteria | CA | ICWAI CMA |

| Full-form | Chartered Accountancy | Cost Management Accounting |

| Purpose | Knowledge of taxation | How to manage finance |

| Eligibility | Class 12th | Class 10th |

| Job profile | Includes work in Accountancy | Includes Cost of Financial Transaction |

Read More: CA

CMA vs CFA

Listed below are the difference between CMA and CFA in India:

| Full-Form | Chartered Financial Analyst | Certified Management Accountants |

| Course Duration | 1.5 - 4 years | Around 3 years |

| Eligibility | Have a bachelor's (or equivalent) degree, or be in the final year of a bachelor's degree at the time of registration, or have 4 years of qualified, professional work experience or a combination of work/college experience that totals four years. | Candidates must have passed the CMA Foundation exam and received their 10+2 diploma from a recognised board in any subject. Work experience in a related field may be requested as well. |

| Average Fees | INR 1.9 - 5.86 LPA | INR 4,000 P.A - INR 41,000 P.A |

| Entrance Exam | No entrance exam | The CMA examination is administered by the Institute of Chartered Accountants of India (ICAI), formerly known as the Institute of Cost and Work Accountants (CMA). The Institute of Cost Accountants, also known as ICMAI, administers the exam twice a year in June and December. |

| Top Colleges | Narayana School of Business, GCEC, International College of Finance Planning | St.Joseph’s College of Commerce, Garden City University |

Read More: CFA

CMA vs CPA

Listed below are the difference between CMA and CPA in India:

| Full-Form | Certified Public Accountants | Certified Management Accountants |

| Course Duration | 1.5 - 4 years | Around 3 years |

| Eligibility | Have a bachelor's (or equivalent) degree, or be in the final year of a bachelor's degree at the time of registration, or have 2 years of qualified, professional work experience or a combination of work/college experience that totals two years. | Candidates must have passed the CMA Foundation exam and received their 10+2 diploma from a recognised board in any subject. Work experience in a related field may be requested as well. |

| Average Fees | INR 1.9 LPA | INR 4,000 P.A - INR 41,000 P.A |

| Entrance Exam | No entrance exam | The CMA examination is administered by the Institute of Chartered Accountants of India (ICAI), formerly known as the Institute of Cost and Work Accountants (CMA). The Institute of Cost Accountants, also known as ICMAI, administers the exam twice a year in June and December. |

Difference Between CWA, CMA, ICMAI, and ICWAI

ICA offers CMA courses in three stages.

CMA as Cost and Management Accountant and termed as Cost and Work Accountant (CWA).

- All the institutes offering courses are the same from the basic level, but ICA is now termed as Institute of Cost and Work Accountants of India (ICWA). ICWA changed its name and renamed it the Institute of Cost and Management Accountants of India (ICMAI).

- In Particular, there is no difference between CWA and CMA. The two courses are the same, and only the name had changed in the previous years.

- ICWA, ICMAI, and ICAI are all the same institute, but their names have changed over the years. Apart from spelling, there is no change in the initial meaning.

Syllabus and Subjects for CMA

The structure of the syllabus and subjects for CMA is defined by internships, mentorships, workshops by experts and studying the fundamental of business mathematics, statistics, laws and ethics, and so on. Some of the important subjects of the CMA course are:

- Fundamentals of Business Mathematics and Statistics

- Fundamentals of Laws and Ethics

- Fundamentals of Economics and Management

- Company Accounts and Audit

- Direct Taxation

Read More: CMA Syllabus and Subjects

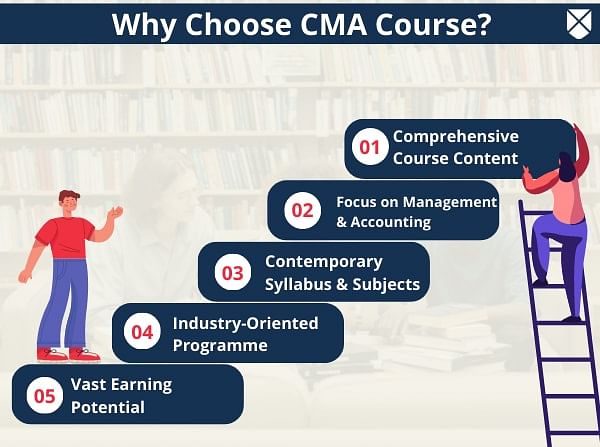

Why Choose CMA Course?

The answer to "Why to choose a Cost Management Accounting degree course?" can be explained and interpreted by the following points:

What is CMA all About?

CMA certification is a three-year-long programme that focuses on theoretical and practical abilities that students must have in areas such as accounting, finance, consulting, and counselling. The curriculum includes topics such as Fundamentals of Business Mathematics and Statistics, Accounting Fundamentals, Economics and Management Fundamentals, Company Accounts and Audit, Direct Taxation, and many more. The activity scope for CMA guides in India and abroad is diverse, with graduates earning competitive salary. Some of the most essential CMA route information is defined below.

What Does a CMA Graduate Do?

The scope of CMA is quite vast, similar to the responsibilities of a CMA course graduate. Below are just some of the job descriptions of potential CMAs:

Collecting Financial Information: Cost accounting graduates are responsible for the collection, adjustment, auditing, monitoring and scrutinizing of all financial information relating to management or financial institute. The purpose of cost accounting is for budget preparation and profitability analysis.

Plan and Budget Monetary Activities: Cost accounting graduates help to plan, budget, analyze and monitor performance, set standard unit costs and recommend appropriate cost-saving opportunities which will be beneficial for the organization. The role is important in understanding where a company is spending money and which products, departments or services are most profitable.

Reasons Why CMA Can Fetch You a Rewarding Career

The CMA course is extremely tough and will test aspirants to their intellectual limits. However, there are numerous benefits to completing the CMA course which can be motivating to any CMA course student. The advantages of doing the CMA course are:

Demand: There is a high demand for CMA graduates in the market because there are numerous control companies, and economic and accounting institutes that require graduates, so it is a completely worthwhile career. The procedure is also precise in that aspirants must collaborate with accounting and control firms to resolve a variety of finance-related issues.

Decent Salary and Job Growth: A CMA's scope and revenue in India are approximately INR 4.5 LPA. As a result, graduates in this field have a high potential for advancement, and the working environment is also favourable.

Multiple Sources of Income: Cost Accountants can do their daytime job and freelancing for individuals such as counselling and consulting in need of any management or finance-related problem arising in any organization.

Read More: CMA Jobs and Scope

Preparation Tips For CMA Course

Below are some preparation tips that aspirants can follow in preparation for the CMA course:

Go Through The Syllabus: Students pursuing the course should study regularly and should be aware of the topics in the syllabus and always be prepared for the examinations ahead.

Get The Basics Right: All the aspirants pursuing the course should focus on their course right from the beginning of the class to the end to strengthen the foundation. Also, it, the students should ensure they have these basics right before them, before going on to advanced topics.

Mock Tests: Mock exams are one of the fine methods for graduates to put together for checks with the aid of using giving them the fine. Attending more and more mock exams previous to the real examination lets college students live updated and carry out properly withinside the real checks.

Scope Of CMA For Higher Education

The CMA route has a wide range of process opportunities in India and a high earning potential in nearly all non-public and public sectors of numerous professional firms in India and abroad. Graduates who complete the CMA route and want to expand their knowledge in the finance and accounting sectors can enrol in the CPA or CFA route. Following CMA course, here are a few alternatives for better training:

Salary of a CMA Graduate

The CMA Salary in India ranges from INR 2.5 LPA - 7 LPA and some additional benefits such as bonuses and incentives. The graduates' salary and the additional benefits may vary depending on the graduates' skills, talent, and experience. So being efficient in every job sector is necessary for graduates to get a higher CTC.

Read More: CMA Salary

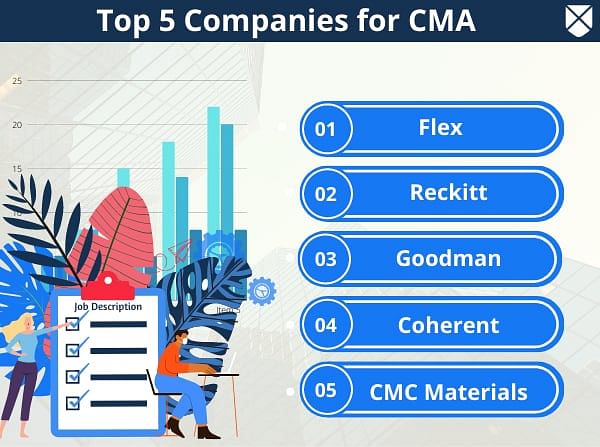

Career Options After CMA

After completing the CMA course in India and abroad, many job opportunities are opened for graduates with a decent salary and some additional benefits in the public and private sectors of various reputed organizations operating in India and abroad.

Some of the very best career options for graduates after the course of CMA in the government sector are as follows:

- Finance Controller

- Senior Accountant

- Manager-Finance

- Accountant

- Tax Manager

Some of the very best CMA careers in the private sector are:

- Chief Finance Officer

- Financial Analyst

- Corporate Controller

- Chief Investment Officer

Skills That Make You The Best CMA Graduate

CMA course graduates must have certain skills in their course curriculum in order to progress as the best cost accountants or finance professionals. The following are some of the skills required of CMA graduates:

- Communication Skills

- Analytical Skills

- Accounting Knowledge

- Problem Solving Skills

- Interpersonal Skills