CA: Full Form, Course Details, Fees, Eligibility, Admission, Duration, Exam Structure

CA or Chartered Accountant course is a five-year professional certification course that focuses on the practice of taxation, accounting, auditing, financial assessment, and budgeting, for an individual, business, or organization. The Chartered Accountant (CA) course in India comprises three levels (Foundation, Intermediate, Final) with challenging exams conducted by the ICAI twice a year. Completing the course and subsequent 3 years of practical training under a CA allows a candidate to become a Chartered Accountant.

CA course registration requires students to have a minimum of 50% in 10+2 (high school degree). The eligibility criteria vary for foundation, intermediate, and final CA exam levels. The CA course syllabus and structure differ as per the level of the course that involves the study of corporate law, accounting, business law, financial management, etc. The course also includes compulsory training programs like Information Technology and Soft Skills (ICITSS and AICITSS).

Table of Contents

- What is CA Course?

- Why Choose the Chartered Accountant (CA) Course?

- CA Eligibility Criteria

- CA Admission Process

- CA Course Duration

- CA Course Fees

- Top CA Institutes in India

- CA Subjects and Syllabus

- CA Skill Assessment & Marking Scheme

- How to Become a CA in India?

- CA Course Comparison

- Courses After CA

- Career Options After Chartered Accountancy Course

- CA Salary in India

- Skills to Excel as a Chartered Accountancy Graduate

CA Course Details

| Degree | Certificate |

| Full Form | Chartered Accountancy |

| Duration | 5 Years |

| Age | 17 years |

| Minimum Percentage | A minimum of 50% marks in 10+2 (high school degree) |

| Average Fees | ₹2 - 2.5 LPA |

| Similar Options of Study | ACCA, CMA, CPA, CFA |

| Average Salary | INR 8.5 LPA. |

| Employment Roles | Accountant, Financial Manager, Banker, Taxation Consultant, Consultant and more. |

| Top Recruiters | Deloitte, EY, KPMG, PwC, Infosys, Accenture, State Bank of India (SBI) etc. |

What is CA Course?

CA full form is Chartered Accountant. The course is divided into three levels: Foundation, Intermediate, and Final. Each level involves clearing an exam conducted by the Institute of Chartered Accountants of India (ICAI). After clearing the Intermediate level, students undergo three years of practical training (Articleship) under a practicing CA. The CA course duration is 4-5 years, including practical training.

The Chartered Accountant (CA) course in India is a prestigious professional qualification for aspirants seeking careers in finance, accounting, auditing, and taxation. CAs are highly sought-after professionals with excellent career prospects and high salaries. CA course enables students to work in various areas like public accounting firms, consulting firms, MNCs, etc. The average salary of a CA graduate is INR 8.5 LPA.

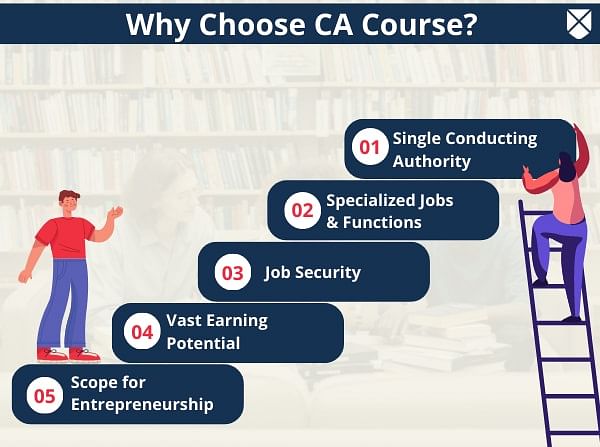

Why Choose the Chartered Accountant (CA) Course?

When deciding to pursue Chartered Accountancy as a career path, students must ensure that they do thorough research on the course. Below are points regarding why choose a CA course:

- The increase in demand for skills for CA graduates has grown by 15% due to the growth of the economy and new financial regulations.

- In recent years the growth of the financial sector is approx 8.5% and is expected to rise, leading to high demand for skilled finance and accounting professionals.

- After completing the entire course, students are presented with many job opportunities in the finance department as an internal auditor, tax consultant, and more.

- The education that graduates receive in this course directly trains the students with all the important information relating to the finance sector of the economy.

CA Eligibility Criteria

Students who have completed their 10+2 (high school degree) with a minimum of 50% in the commerce stream are eligible to pursue the Chartered Accountancy course. The Eligibility for CA courses differs according to the three different CA levels.

- CA Foundation Eligibility Criteria

- CA Intermediate Eligibility Criteria

- CA Final Eligibility Criteria

CA Foundation Eligibility Criteria

To be eligible for the CA Foundation level, students must meet the following eligibility requirements:

- Candidates must have completed the 10+2 examinations from a recognized board with a minimum of 50% marks.

- The candidate should have completed the registration with the ICAI.

- Students of all ages can apply for the CA Foundation course.

Read More: CA Foundation

CA Intermediate Eligibility Criteria

To be eligible for the CA Intermediate level, students must meet the following eligibility requirements:

- Candidates must have cleared the foundation-level CA exam.

- A candidate also needs a bachelor's or master's degree with a 50-60% mark from a recognized university.

- The candidate should have completed the registration with the ICAI for the Intermediate level.

- To have a CA Intermediate level certificate, candidates should also finish 9 months of practical training which can be started after passing Group I of the Intermediate CA exam.

Read More: CA Intermediate

CA Final Eligibility Criteria

To be eligible for CA final level, students must meet the following eligibility requirements:

- Candidates must have cleared the Intermediate level CA exam (Group 1 & 2).

- The candidate should have completed the registration with the Institute of Chartered Accountants of India for the final level and paid the fees.

- The candidate should also complete 3 years of practical training (Articleship).

- A candidate also needs to complete a four-week Advanced Information Technology Training.

Read More: CA Final

What is Articleship in Chartered Accountancy?

The Articleship or training in CA is mandatory for students to complete. CA Articleship training begins once the student has completed one or both CA intermediate groups. To be eligible for the CA Articleship program, here are the following pointers:

- Before beginning the CA articleship, students must complete a 100-hour ITT and orientation program.

- For direct enrollment, the candidate requires 55% to 60% marks in their graduation depending on their stream.

Read More: CA Articleship

CA Admission Process

The process for CA admission in India can seem complex but can be completed by two routes given by ICAI. The following are the two types of approval procedures to earn CA Certification.

- CA After Class XII through CA Foundation (Foundation Route)

- CA After Graduation through Direct Entry Route

CA After Class XII through CA Foundation (Foundation Route)

Candidates who want to pursue the Chartered Accountancy course after 12th grade must first qualify for the CPT/ CA Foundation exam. The CA exam is held twice a year in May and November, with registration deadlines in April and October, respectively.

Below mentioned are the CPT Route details:

- Candidates should have completed the Class 12th examination from a recognized board to be eligible for the CA Foundation course.

- Candidates waiting for their 12th results can provisionally apply for the course.

- A candidate should complete the registration with ICAI to appear for the exam by paying CA foundation registration fees.

- Aspirants can apply for the IPCC (Integrated Professional Competence Course) after passing the CPT/ CA Foundation exam, and their 12th-grade examinations.

CA After Graduation through Direct Entry Route

Below mentioned are details regarding the CA certification course through direct entry:

- CA courses offer seats to candidates immediately following graduation, exempting them from the CPT. To do so, one must graduate with a minimum of 50-55% marks, allowing them to take the IPCC exam and begin their articles.

- A direct entry candidate must complete nine months of mandatory articleship training to be eligible for Intermediate CA Exams.

- Candidates who have cleared the intermediate level of CS executive or CMA are eligible for direct entry.

Comparison Between CPT Route and Direct Entry Scheme

Below is a comparative table highlighting the differences between CPT Route and Direct Entry Scheme in Chartered Accountant Course:

|

Particulars |

CPT Route |

Direct Entry Scheme |

|

Eligibility |

After XII |

After Graduation or Passed CS Executive or Passed the CMA Intermediate Exam |

|

Exemptions |

No Exemptions |

CPT Exempted |

|

Minimum Duration |

4.5 years |

3 years |

|

Eligibility to start Articleship |

After clearing Group I of the IPCC |

Immediately upon joining without clearing the IPCC Group I |

Also, Check: Difference Between CA CPT and CA Foundation

CA Course Duration

In India, the duration of the CA (Chartered Accountancy) course varies depending on the individual's progress and the time required to pass each level of test. The following is an approximate breakdown of the duration of each level of the CA course:

|

S.No |

CA Level |

Duration |

|

1. |

Foundation Course |

A minimum of 4 Months |

|

2. |

Intermediate Course |

A minimum of 8 Months |

|

3. |

Articleship Training |

3 Years |

|

4. |

Final Course |

A minimum of 4-5 Months |

Also, Read on How to Prepare for CA Foundation without Coaching

CA Course Fees

The CA course fees vary for foundation, intermediate and final levels. The registration fees are decided by the ICAI. Below mentioned are the estimated registration fees for the Chartered Accountancy (CA) course:

|

S.No |

CA Level |

CA Registration Fees |

|

1 |

Foundation Level |

INR 9,000 |

|

2 |

Intermediate Level |

INR 18,000 |

|

3 |

Articleship Fees |

INR 2,000 |

|

4 |

Integrated Course on Information Technology and Soft Skills (ICITSS) |

INR 7,000 |

|

5 |

Direct Entry |

INR 34,000 |

|

6 |

Final Level |

INR 22,000 |

Top CA Institutes in India

Below is the list of the ten best CA institutes that help students to prepare well for the CA Exam:

|

S.No. |

Name of the Institute |

Average Fees |

|

1 |

Aldine CA |

INR 19,000 PA |

|

2 |

Academy of Commerce |

- |

|

3 |

Resonance |

INR 20,000 PA |

|

4 |

Vidya Sagar Career Institute Ltd |

INR 45,000 PA |

|

5 |

Chanakya Academy for Management and Professional Studies (CHAMPS) |

- |

|

6 |

KSG Square |

- |

|

7 |

Northern India Regional Council of ICA |

INR 11,000 PA |

|

8 |

Nahata Professional Academy |

INR 43.000 PA |

|

9 |

Navkar Institute |

INR 60,000 PA |

|

10 |

Mital Commerce Classes |

INR 41,000 PA |

| Best CA Foundation Coaching Centres in India | Best CA Final Coaching Institue in India |

CA Subjects and Syllabus

The chartered accountancy syllabus differs according to each course level. The syllabus is divided into three parts: CA Foundation, CA Intermediate, and CA Final Level. Below mentioned is the detailed syllabus for each level of the CA course details:

CA Foundation Syllabus

CA Foundation is an entry-level examination for students pursuing a Chartered Accountancy (CA) course. The syllabus for CA Foundation is given by the ICAI. The major 4 subjects or papers are listed below:

- Paper 1: Principles and Practice of Accounting

- Paper 2: Business Law and Business Correspondence and Reporting

- Paper 3: Business Mathematics and Logical Reasoning & Statistics

- Paper 4: Business Economics and Business and Commercial Knowledge

CA Intermediate Syllabus

CA Intermediate is the second-level examination for students pursuing a Chartered Accountancy course. The syllabus as given by the Institute of Chartered Accountants of India is bifurcated into two groups consisting of 8 subjects.

Group 1 has 4 subjects or papers as given below:

- Paper 1: Accounting

- Paper 2: Corporate and Other Laws

- Paper 3: Cost and Management Accounting

- Paper 4: Taxation

Group 2 has 4 subjects or papers as given below:

- Paper 5: Advanced Accounting

- Paper 6: Auditing and Assurance

- Paper 7: Enterprise Information Systems and Strategic Management

- Paper 8: Financial Management and Economics for Finance

CA Final Syllabus

CA Final is the last level examination for students pursuing a CA course. The level consists of 2 groups divided into 8 papers/ subjects as given below:

Group 1 consists of 4 subjects or papers as given below:

- Paper 1: Financial Reporting

- Paper 2: Strategic Financial Management

- Paper 3: Advanced Auditing and Professional Ethics

- Paper 4: Economics and Corporate Law

Group 2 consists of 4 subjects or papers as given below:

- Paper 5: Strategic Cost Management and Performance Evaluation

- Paper 6: Elective Subject

- Paper 7: Direct Tax Laws and International Taxation

- Paper 8: Indirect Tax Law

Read More: CA Syllabus and Subjects

CA Skill Assessment & Marking Scheme

The Chartered Accountancy course tests certain skills and knowledge of the applicants essential for them to become successful Chartered Accountants. Below are the skill assessments for all 3 levels of the Chartered Accountancy course:

CA Foundation Marking Scheme

The CA Foundation assessments are based on the comprehension and application skills of the candidates. Below is the marking scheme of the CA Foundation course:

| Paper | Level I: Comprehension and Knowledge | Level II: Application Skills |

| Principles and Practice of Accounting | 5%-20% | 80%-95% |

| Business Laws | 50%-65% | 35%-50% |

| Business Correspondence and Reporting | 100% | - |

| Business Mathematics & Logical Reasoning, Statistics | - | 100% |

| Business Economics | 40%-50% | 50%-60% |

| Business and Commercial Knowledge | 100% | - |

Also, Check: How to Clear CA Foundation on First Attempt?

CA Intermediate Marking Scheme

The CA Intermediate assessment is based on the candidates' comprehension and application skills. The marking scheme for the CA Intermediate course is as follows:

| Papers | Level I: Comprehension and Knowledge | Level II: Application Skills |

| Accounting | 5%-15% | 85%-95% |

| Paper 1. Company Law | 40%-55% | 45%-60% |

| Paper 2. Other Laws | 35%-55% | 45%-65% |

| Cost and Management Accounting | 20%-30% | 70%-80% |

| Section A: Income Tax Law | 5%-20% | 80%-95% |

| Section B: Indirect Tax Law | 20%-45% | 55%-80% |

| Advance Accounting | 5%-15% | 85%-95% |

| Auditing and Assurance | 30%-55% | 45%-70% |

| Enterprise Information System | 40%-65% | 35%-60% |

| Strategic Management | 50%-70% | 30%-50% |

| Financial Management | 20%-30% | 80%-70% |

| Economics For Finance | 60%-80% | 20%-40% |

CA Final Marking Scheme

The candidate's comprehension, analysis, application, evaluation, and synthesis skills are assessed in the CA Final. The following is the marking scheme for the CA Final course:

| Papers | Level I: Comprehension and Knowledge | Level II: Analysis and Application Skills | Level II: Evaluation and Synthesis |

| Financial Reporting | 5%-15% | 55%-85% | 15%-25% |

| Strategic Financial Management | 0%-20% | 20%-40% | 50%-60 |

| Advanced Auditing and Professional Ethics | 15%-25% | 40%-70% | 20%-30% |

| Paper 1. Corporate Law | 15%-25% | 40%-55% | 30%-35% |

| Paper 2. Economic Law | 30%-50% | 50%-70% | |

| Strategic Cost Management and Performance Evaluation | 0%-15% | 45%-55% | 35%-40% |

| Direct Tax and International TaxationPart 1. Direct Tax Laws | 5%-10% | 55%-75% | 20%-35% |

| Part 2. International Taxation | 40%-50% | 50%-60% | |

| Indirect TaxPart 1. Goods & Service Tax | 10%-30% | 40%-70% | 20%-30% |

| Part 2. Customer & FTP | 20%-40% | 40%-70% | 10%-20% |

How to Become a CA in India?

To become a Chartered Accountant, candidates must complete several steps, including meeting eligibility requirements and applying for and completing the required degree. Below are the steps on how to become a chartered accountant:

- Step 1: A student must register for a foundation course. Registration can be done online through the ICAI website.

- Step 2: The candidate must clear the foundation course consisting of four papers.

- Step 3: Further, the candidate should register for the Intermediate course and clear either Group I or Group II or both groups for the CA examination.

- Step 4: After clearing any one group or both a candidate has to undergo Articleship training.

- Step 5: Further clearing both the groups of intermediate courses, the candidate should register for the final course.

- Step 6: A candidate must complete 3 years of Articleship training and complete Advanced Integrated Course on Information Technology and Soft Skills.

- Step 7: A candidate should clear the final CA examinations and then apply for membership with the ICAI.

Read More: How to Become a CA in India?

CA Course Comparison

There are other courses that aspirants can pursue to become Chartered Accountants. However, slight differences make these courses distinct from the Chartered Accountant course. We have provided comparisons of the CA course with other accounting courses for your reference:

ACCA VS CA

CA and ACCA degrees are similar in terms of functionality and opportunities. However, there are a few distinctions, which are listed below:

|

Full-Form |

Chartered Accountant |

Association of Chartered Certified Accountants |

|

Course Duration |

4 to 5 years |

3 – 4 years |

|

Eligibility |

10+2 with minimum 50% aggregate marks. |

10+2 with Accounting and Maths, with a minimum of 60% aggregate marks. |

|

Average Total Fees |

INR 2 -2.5 Lakhs |

INR 1.5 - 3 LPA |

|

Average Salary |

INR 8.5 LPA |

INR 6.24 LPA |

Read More: CA vs ACCA

CA vs CPA

CA and CPA degrees are similar in terms of functionality and opportunities. However, there are a few distinctions, which are listed below:

|

Full-Form |

Chartered Accountant |

Certified Public Accountant |

|

Course Duration |

4 to 5 years |

2 to 4 years |

|

Eligibility |

10+2 with minimum 50% aggregate marks. |

Bachelor's degree in commerce with economics, mathematics, and accounts as core subjects. |

|

Average Total Fees |

INR 2 -2.5 Lakhs |

INR 3.5-4 Lakhs |

|

Average Salary |

INR 8.5 LPA |

INR 8 LPA |

CFA vs CA

Given below are the differences between the CA and CFA courses:

|

Course |

Chartered Financial Analyst |

Chartered Accountancy |

|

Course Duration |

1.5 - 4 years |

4-5 years |

|

Eligibility |

Bachelor's degree or 4 years of professional work experience |

10+2 with minimum 50% aggregate marks. |

|

Average Total Fees |

INR 1.9 - 3.86 Lakhs |

INR 2 -2.5 Lakh. |

|

Average Salary |

INR 6.8 LPA |

INR 8.5 LPA |

Read More: CFA vs CA

CMA vs CA

Given below are the differences between the CA and CMA course:

|

Course |

Cost Management Accounting |

Chartered Accountancy |

|

Course Duration |

3 Years |

4-5 Years |

|

Eligibility |

10+2 with a minimum of 50% aggregate marks with commerce. |

10+2 with a minimum of 50% aggregate marks. |

|

Average Total Fees |

INR 50,000-2.5 Lakhs |

INR 2 -2.5 Lakh. |

|

Average Salary |

INR 2.5 LPA - 7 LPA |

INR 8.5 LPA

|

Read More: CMA Vs CA

Courses After CA

After completion of CA students can pursue various certification courses to enhance knowledge and domain expertise. Below listed are various certification courses that students can enroll in after CA:

- Certified Internal Auditor (CIA)

- Certified Public Accountant (CPA)

- Chartered Financial Analyst (CFA)

- MBA

- DISA or Diploma in Information System Audit

Career Options After Chartered Accountancy Course

The CA course is a very rewarding and promising career path for graduates. CA qualification helps students build a career path that will help them get a good job in both public and private sectors. Some of the job roles for students are mentioned below:

- Auditor

- Tax Consultant

- Financial Analyst

- Financial Controller

- Management Accountant

- Risk Manager

Read More: What Next after Completing CA Final

Top CA Firms

Candidates who have completed the Chartered Accountant course seek employment with the most prestigious chartered accounting firms. Below is a list of the top 20 accounting firms suited for CA graduates.

|

PWC |

SS Kothari |

Sir Dinodia & Co. LLP |

|

KPMG |

RSM International |

Deewan PN Chopra & Co. |

|

Ernst & Young SS Kothari |

Deloitte |

Khanna & Annadhanam |

|

Sahni Natrajan & Bahl |

Suresh Surana & Associate LLP |

C.Vasudeva & Co |

|

BDO International |

Grant Thornton International |

Lodha & Company |

|

Luthra & Luthra |

Desai Haribhakti |

TR Chadha & Company |

|

SP Chopra & Company |

S Aiyar & Company |

- |

Read More: Top CA Firms in India

CA Salary in India

According to Payscale, the average salary is INR 8.5 LPA for a CA in India. However, the salary varies according to different factors such as experience, skills, job designation, industry, organization, location, and more.

Read More: CA Salary in India

Skills to Excel as a Chartered Accountancy Graduate

As a CA graduate, there are various skills one needs to excel in their career. Some of these skills include:

- Financial and Accounting Knowledge

- Teamwork and Collaboration

- Adaptability and Resilience

- Problem-Solving Abilities

- Ethical Conduct

- Communication skills

- Time Management

Top CA (Chartered Accountancy) Colleges

CA Fee Structure

FAQs on CA

Q: What is CA duration?

Q: What is the full form of CA?

Q: What is the CA Foundation registration fees?

Q: What are the subjects at the ICAI CA foundation level?

Q: Who provides a CA certificate?

Q: Is there any CA entrance exam?

Q: What are the job opportunities available after completion of the CA course?

Q: Are there any scholarships available to CA students?

Q: How to become CA after 12th?