Tamil Nadu 12th Accountancy Exam Pattern 2026 – Check Marking Scheme

Table of Contents

The Tamil Nadu 12th Accountancy Exam Pattern 2026 has a very clear-cut structure. The exam pattern’s knowledge solves many kinds of doubts. It will assist you in knowing the format of the question paper and the marking method. You will also come to know about the weightage process. So, if you have begun preparing for the Tamil Nadu 12th Exam 2026, then pursue only the latest exam pattern.

The Tamil Nadu 12th Exam Pattern 2026 has an uncomplicated design. The total estimation of the Accountancy exam is one hundred marks. Out of this assessment, 90 marks are for the main theory paper. 10 marks are for the internal assessment. The timeline of the paper is 3 hours, and there is nil negative marking in this exam. There will be 4 unique parts in the question paper. You will see different types of questions, such as MCQs, short, very short, and long types.

This article covers all the details related to the Tamil Nadu 12th Accountancy Exam Pattern 2026. So, if you are worried about your Board exam, then relax your mind. You will get all the answers through this write-up.

Tamil Nadu 12th Accountancy Exam Pattern 2026 – Subject Wise

The Tamil Nadu 12th Accountancy Exam Pattern has a very simple structure. The theory exam’s weightage is 90 marks. 10 marks are for the internal assessment. Hence, the whole assessment of the Accountancy paper is one hundred marks. You will get 3 hours for the main theory paper. There will be four parts in the question paper (I, II, III, and IV). In Part I, you will have to answer twenty MCQs of 1 mark each. In Part II, you have to solve seven very short questions of 2 marks each. In Part III, you have to answer seven short questions of 3 marks each. In Part IV, there will be seven long questions of 5 marks each. If you want a simple analysis of the Tamil Nadu 12th Accountancy question paper pattern, then go through the table below.

|

Parts |

Type of questions |

Number of questions |

Marks allotted |

|

I |

MCQs |

Question numbers 1 to 20 – 1 mark each |

20 x 1 = 20 |

|

II |

Very short |

Question numbers 21 to 30 – 2 marks each (Answer any 7 questions, however question number 30 is compulsory) |

7 x 2 = 14 |

|

III |

Short |

Question numbers 31 to 40 – 3 marks each (Answer any 7 questions, however question number 40 is compulsory) |

7 x 3 = 21 |

|

IV |

Long |

Question numbers 41 to 47 – 5 marks each |

7 x 5 = 35 |

|

Total |

|

47 questions |

90 marks |

Also Read: Tamil Nadu 12th Accountancy Syllabus 2026

Tamil Nadu 12th Accountancy Marking Scheme 2026

The table below provides the Tamil Nadu 12th Accountancy marking scheme in a simple format. Check out the information and get absolute clarity about the marking pattern.

|

Sections |

Type of questions (An approximate evaluation) |

Number of questions (An approximate evaluation) |

Marks allotted (An approximate evaluation) |

|

Accounts in case of incomplete records |

MCQs, Very Short, Short |

4 |

8 |

|

Accounts of NPOs |

MCQs/Very Short/Short/Long |

5 |

10 |

|

Accounts of partnership firms (fundamentals) |

MCQs/Very Short/Short/Long |

4 |

8 |

|

Goodwill in case of partnership accounts |

MCQs/Very Short/Short/Long |

4 |

8 |

|

Admission of a partner |

MCQs/Very Short/Short/Long |

6 |

12 |

|

Retirement/death of a partner |

MCQs/Very Short/Short/Long |

7 |

12 |

|

Financial-statement analysis |

MCQs/Very Short/Short/Long |

8 |

14 |

|

Ratio analysis |

MCQs, Very Short, Short |

5 |

10 |

|

Computerized accounting system (Tally) |

MCQs, Very Short, Short |

4 |

8 |

|

Total |

|

47 questions |

90 marks |

|

Internal Assessment |

|

|

10 marks |

|

Total Valuation of the Tamil Nadu 12th Accountancy Exam |

|

|

100 marks |

Also Read: Tamil Nadu 12th Accountancy Deleted Syllabus 2026

Tamil Nadu 12th Accountancy Unit Wise Marking Scheme 2026

If you want to know the Tamil Nadu 12th Accountancy unit-wise marking scheme, then the table below will help you to understand the exact classification. Here are the details -

|

Topics/Units |

Weightage% (An approximate evaluation) |

Marks allotted (An approximate evaluation) |

|

Accounts in case of incomplete records |

9% |

8 |

|

Accounts of NPOs |

11% |

10 |

|

Accounts of partnership firms (fundamentals) |

9% |

8 |

|

Goodwill in case of partnership accounts |

9% |

8 |

|

Admission of a partner |

13% |

12 |

|

Retirement/death of a partner |

13% |

12 |

|

Financial-statement analysis |

16% |

14 |

|

Ratio analysis |

11% |

10 |

|

Computerized accounting system – Tally |

9% |

8 |

|

Total |

100% |

90 marks |

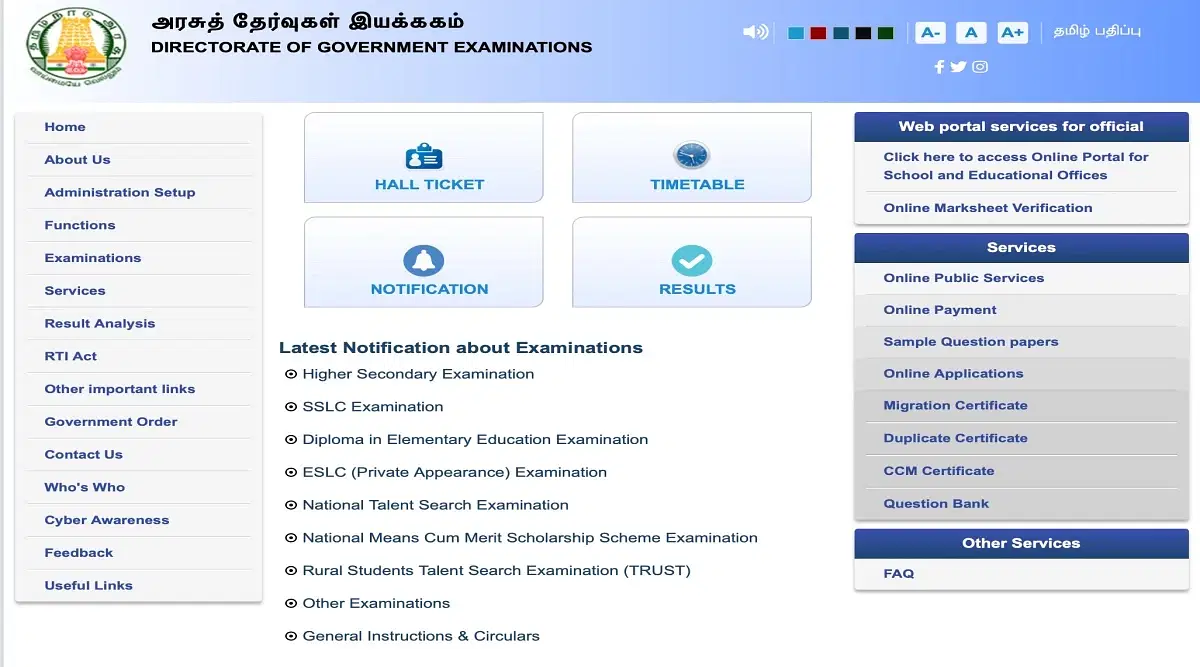

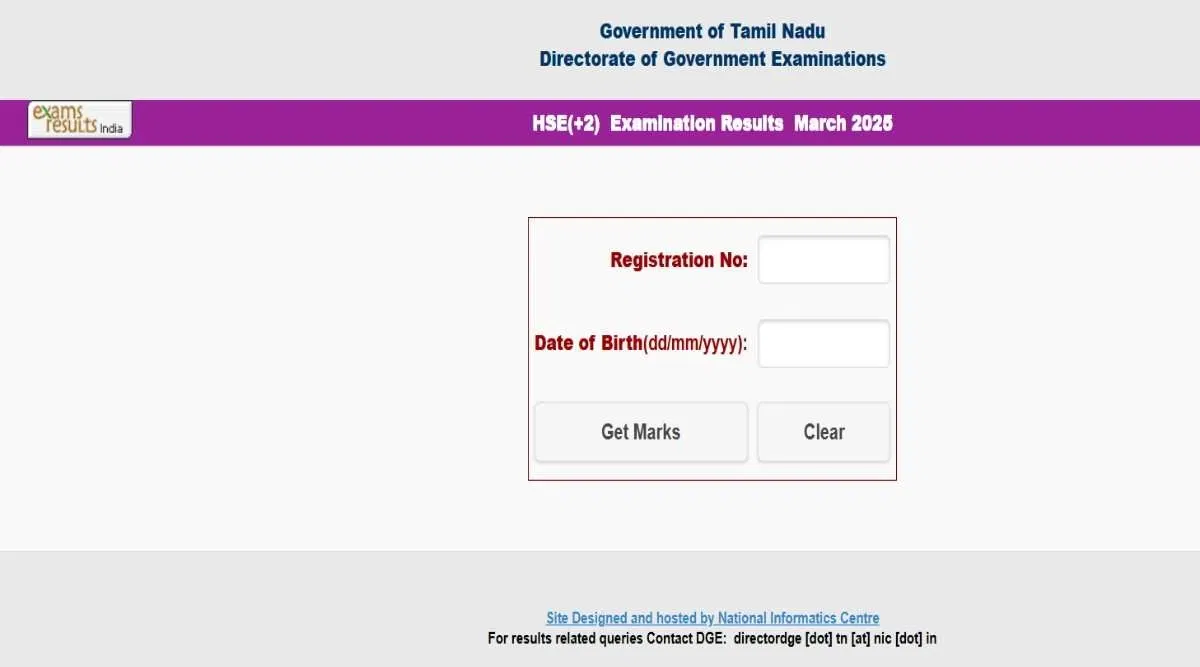

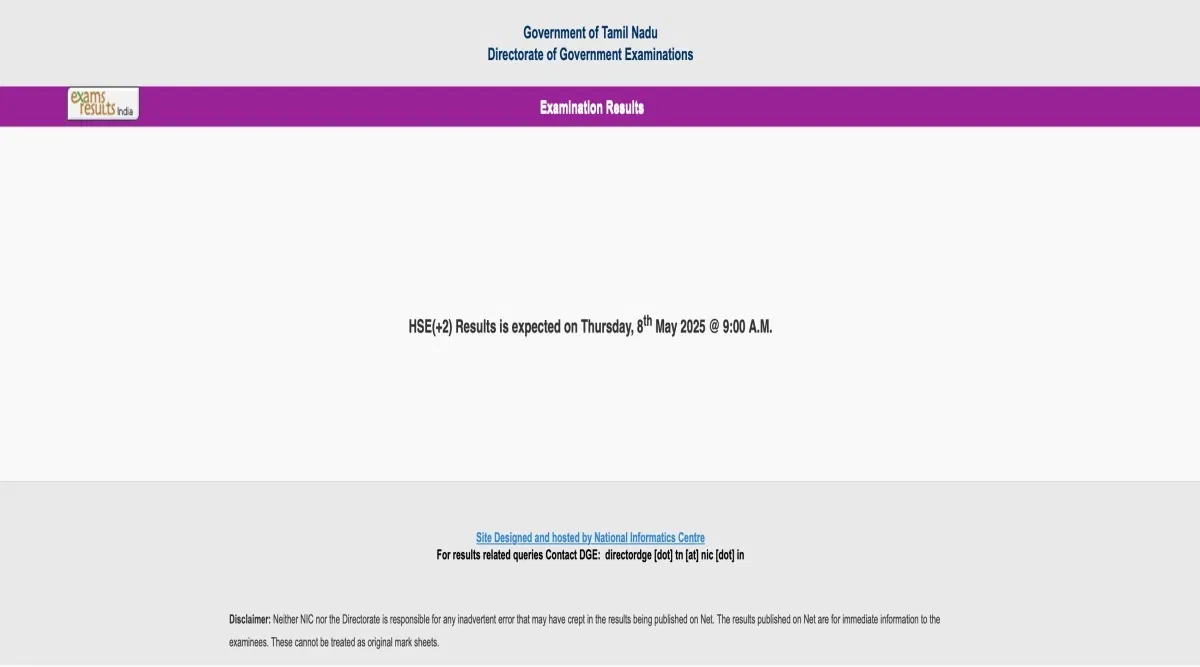

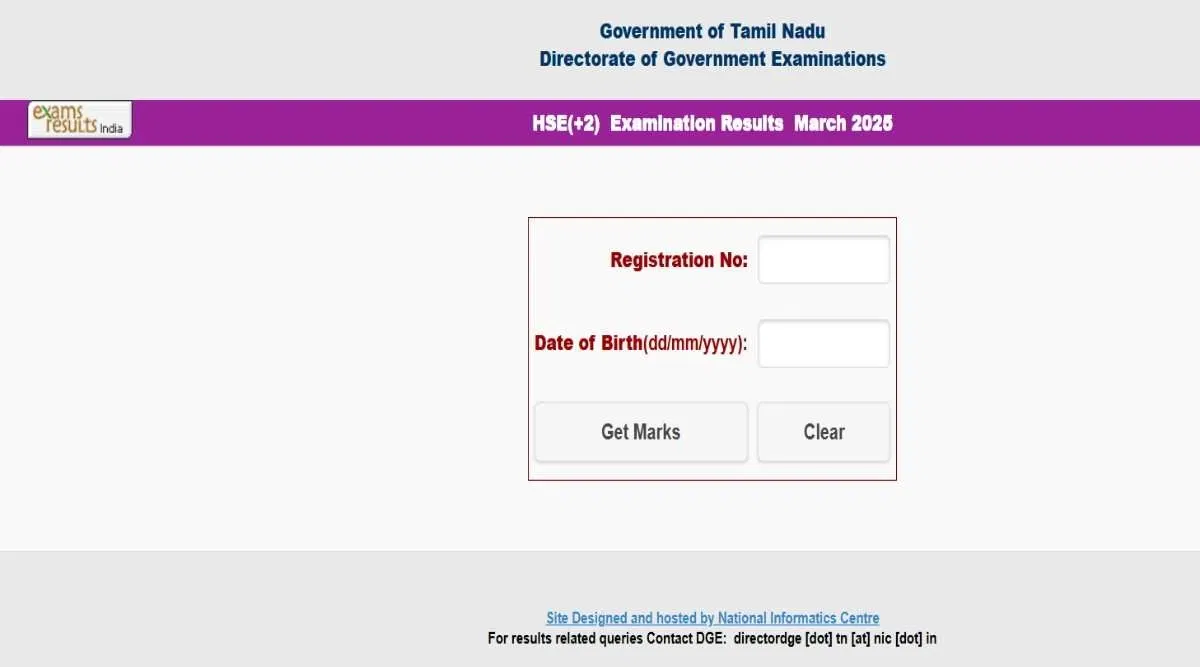

The percentages written in the table above are as per the latest Tamil Nadu 12th Accountancy Exam Pattern. If you want to acquire an official exam pattern’s PDF, then visit the board’s website, dge.tn.gov.in.

Also Read: Tamil Nadu 12th-Admit Card 2026

How to Use the Tamil Nadu 12th Accountancy Exam Pattern 2026?

You can use the Tamil Nadu 12th Accountancy Exam Pattern in the following ways –

-

By analyzing the Tamil Nadu 12th Accountancy Exam Pattern, you will come to know the high-weightage units. This will help you to generate a practical timetable.

-

Exam pattern’s familiarity will help you to understand your weak points in the subject of Accountancy.

-

Knowing the exam pattern always proves to be beneficial. It will reduce exam-related anxiety.

-

If you want to practice in a better way, then you must know the exam pattern beforehand.

-

For balanced revision and full coverage of the Accountancy syllabus, you must analyze the exam pattern in an in-depth manner.

Also Read: Tamil Nadu 12th-Sample Papers 2026

For more constructive updates related to the Tamil Nadu 12th Exam, follow Getmyuni!

FAQs on Tamil Nadu 12th Tamil Nadu 12th Accountancy Exam Pattern

Q: Who sets the Tamil Nadu 12th Accountancy Exam Pattern?

Q: How to obtain the official Tamil Nadu 12th Accountancy Exam Pattern 2026?

Q: How to solve the confusion regarding the Tamil Nadu 12th Accountancy Exam Pattern?

Q: As per the Tamil Nadu 12th Exam Pattern, is there any negative marking in the Accountancy paper?

Q: What is the latest Tamil Nadu 12th Accountancy Exam Pattern?

![Bharathidasan Institute of Technology, [BIT] Anna University, Tiruchirappalli](https://media.getmyuni.com/azure/college-image/small/bharathidasan-institute-of-technology-bit-anna-university-tiruchirappalli.jpg)