Tamil Nadu 12th Accountancy Deleted Syllabus 2026 Check Chapter Wise Syllabus

Table of Contents

- What is the Accurate Tamil Nadu 12th Accountancy Deleted Syllabus 2026?

- How to Get Tamil Nadu 12th Accountancy Syllabus 2026 PDF?

- What is the Exact Tamil Nadu 12th Accountancy Question Paper Pattern 2026?

- What is the Precise Tamil Nadu 12th Accountancy Topics Weightage 2026?

- Benefits of the Tamil Nadu 12th Accountancy Deleted Syllabus 2026

The Directorate of Government Examinations, Tamil Nadu, has the authority to determine the syllabus for the 12th grade in the state. The decision to opt for the Tamil Nadu 12th accountancy Deleted Syllabus is a praiseworthy step. It will help in sinking the educational burden and the curriculum will be optimized. Thus, if you are starting your preparation for the Tamil Nadu 12th Exam 2026 then it is imperative to know the updated syllabus.

The Tamil Nadu 12th Deleted Syllabus will unquestionably help you to save a lot of time. Deletion of certain topics and subtopics in Accountancy will promote a deeper understanding of core concepts. The Board authorities have revised the syllabus in such a way that practical applications of Accountancy are given more importance. The new syllabus aims to make it more relevant to modern-day business practices. Various topics from Company Accounts, Computerized Accounting, Accounting for NPOs, etc. have been removed. The idea is to simplify the syllabus by removing the outdated content. Now, you will get more time to focus on the high-impact and maximum-weightage chapters.

This article discusses all the chief aspects of the Tamil Nadu 12th accountancy Deleted Syllabus. Hence, if you are a Commerce student, the forthcoming details will prove to be highly valuable.

What is the Accurate Tamil Nadu 12th Accountancy Deleted Syllabus 2026?

While preparing for the subject of accountancy, you must know the deleted syllabus. It will help in creating the right study plan. The table below shares the Tamil Nadu 12th accountancy Deleted Syllabus in an easy-to-comprehend style -

|

Chapters |

Deleted Topics |

|

Accounts of Partnership Firms |

Some portion of dissolution (involving insolvency of a partner)

Piecemeal distribution of cash |

|

Admission and Retirement of a Partner |

Memorandum Revaluation Account |

|

Company Accounts – Issue of Shares |

Calls in advance and interest thereon – It has been simplified |

|

Company Accounts – Issue of Debentures |

Certain portions of redemption of debentures and writing off discount/loss on issue of debentures have been removed |

|

Computerized Accounting |

Tally ERP detailed practical (excluding core theoretical concepts)

DBMS and its applications used for generating accounting information |

|

Accounting for Non-Profit Organizations |

Subscription in arrears/advance (detailed calculations) |

|

Interpretation of Financial Statements |

Comparative statements, common size statements – this portion has been reduced |

Also Read: Tamil Nadu 12th Sample Papers

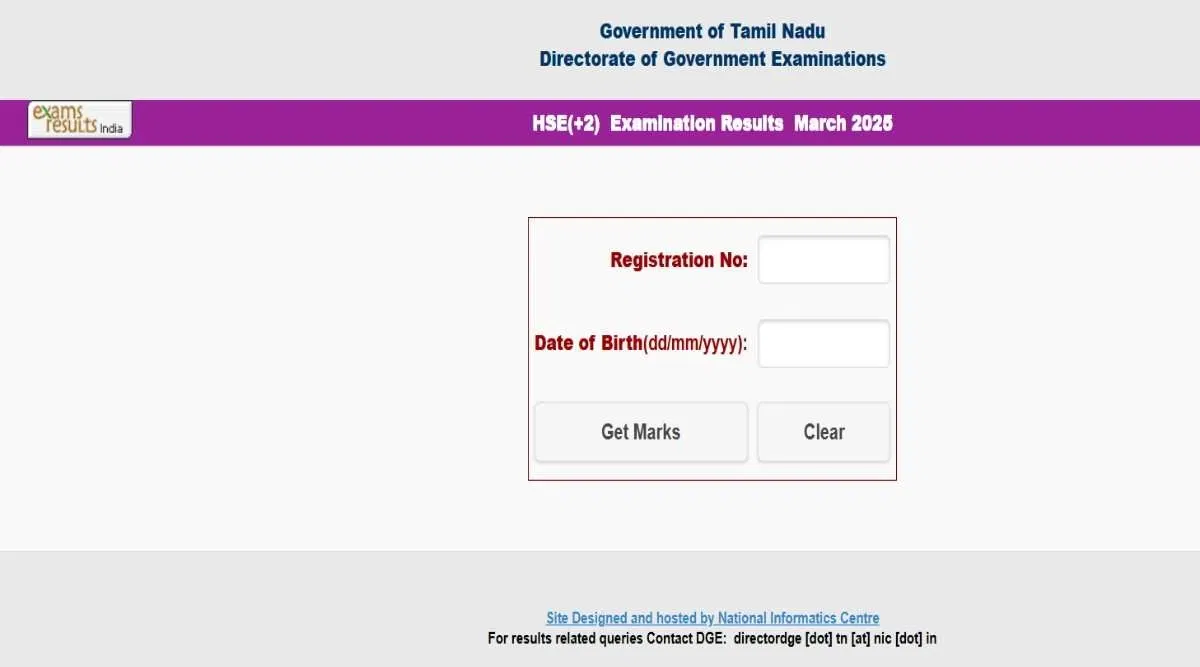

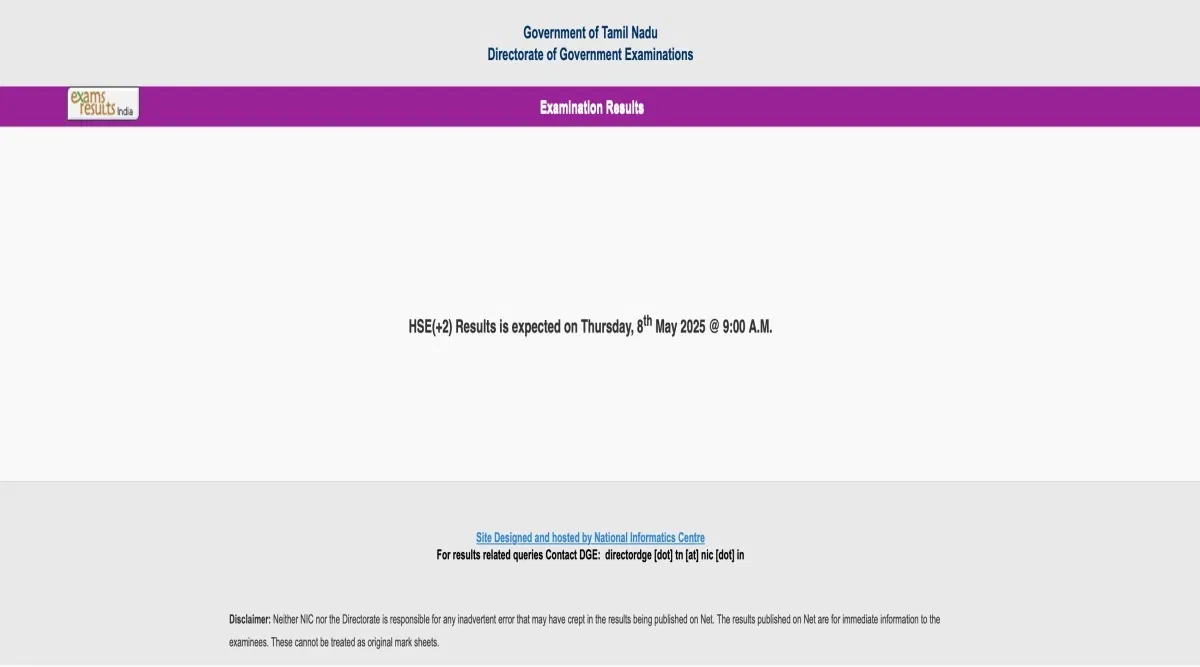

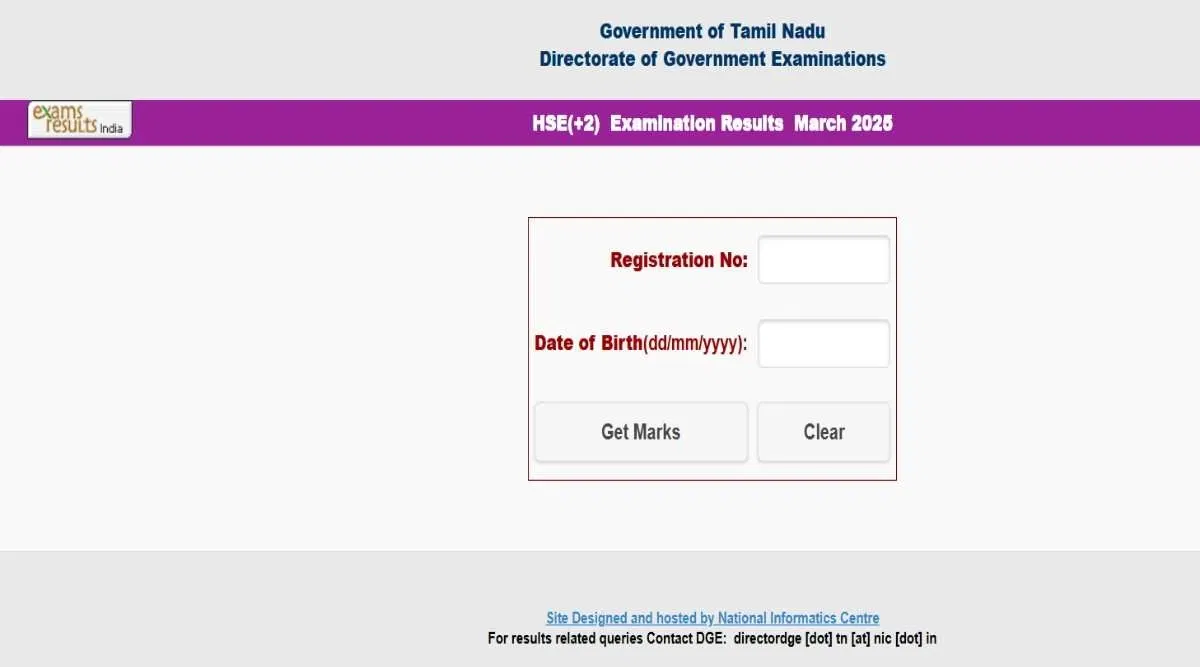

How to Get Tamil Nadu 12th Accountancy Syllabus 2026 PDF?

Whenever you are making a timetable for Accountancy then make sure to follow an updated syllabus. There is no point in solving the questions that belong to the deleted syllabus. The table below shares the updated Tamil Nadu 12th Accountancy syllabus –

|

Tamil Nadu 12th Accountancy Syllabus 2026 – Download PDF |

Also Read: Tamil Nadu 12th Admit Card

What is the Exact Tamil Nadu 12th Accountancy Question Paper Pattern 2026?

The Tamil Nadu 12th Accountancy question paper will carry 90 marks. You will get 3 hours to answer the questions. The question paper will be a mix of MCQs, objective-type questions, very short-answer-type questions, short-answer-type questions, and long-answer-type questions. There will be 4 sections (A, B, C, and D). Section A will have 20 questions of 1 mark each. In section B, you will have to solve 7 questions (2 marks each). In sections C and D also, there will be 7 questions each (3 marks and 5 marks questions). The table below will help you to understand the exact Tamil Nadu 12th Accountancy question paper pattern -

|

Section |

Number of Questions |

Marks Allotted |

|

A |

20 (MCQs and objective-type questions) |

20 x 1 = 20 |

|

B |

7 (very short-answer-type questions)

|

7 x 2 = 14 |

|

C |

7 (short-answer-type questions) |

7 x 3 = 21 |

|

D |

7 (long-answer-type questions) |

7 x 5 = 35 |

|

Total |

|

90 |

Also Read: Tamil Nadu 12th Previous Year Question Papers

What is the Precise Tamil Nadu 12th Accountancy Topics Weightage 2026?

If you want to score excellent marks in the subject of Accountancy then you must know the topic-wise weightage. It will help you to decide the time allocation for each chapter. The table underneath provides a summarized view of Tamil Nadu 12th Accountancy topics weightage -

|

Topics |

Weightage |

|

Accounts of Partnership Firms (Admission, Retirement, and Death of Partner) |

20% |

|

Depreciation, Final Accounts Adjustment |

15% |

|

Company Accounts – Issue of Shares & Debentures, Interpretation of Financial Statements |

20% |

|

Accounting for Non-Profit Organizations, Accounts from Incomplete Records |

10% |

|

Computerized Accounting |

10% |

|

Final Accounts of Sole Proprietor |

10% |

|

Ratio Analysis and Fund Flow Statement, Cash Budget |

10% |

|

Miscellaneous (Theory, Concepts) |

5% |

You must understand that these percentages are the estimated values based on the Accountancy syllabus pattern. If you want the most up-to-date information about the syllabus or weightage, visit the designated website of the board at dge.tn.gov.in.

Also Read: Tamil Nadu 12th Exam Preparation Tips

Benefits of the Tamil Nadu 12th Accountancy Deleted Syllabus 2026

There are many advantages of the Tamil Nadu 12th accountancy Deleted Syllabus. The points revealed below will help you to understand the benefits –

-

Because of the Tamil Nadu 12th accountancy Deleted Syllabus, your academic anxiety will be lessened.

-

A reduced syllabus is the key to scoring excellent marks.

-

You can prepare a better study plan and there will be sufficient time for revision.

-

Due to the decreased syllabus, you can give more time for conceptual understanding.

-

While solving the previous years’ sample papers or question papers, there is no need to attempt the questions from the deleted syllabus.

-

The saved time can also be used for the preparation of other subjects of the Board Exam.

For more such updates about the Tamil Nadu 12th Exam, follow Getmyuni!

![Bharathidasan Institute of Technology, [BIT] Anna University, Tiruchirappalli](https://media.getmyuni.com/azure/college-image/small/bharathidasan-institute-of-technology-bit-anna-university-tiruchirappalli.jpg)