MBA Financial Management: Course Details, Eligibility, Fees, Admission, Duration

MBA Financial Management is a two-year MBA specialization program that offers superior know-how in the finance industry. The purpose of this course is to introduce students to the key skills of management used in the finance sector. This course involves the study of analyzing, budgeting, organizing, and monitoring finance.

The MBA Financial Management course fees range between INR 1.7 - 10 LPA and candidates require a bachelor’s degree with 45-55% marks. The MBA FM course curriculum is industry-relevant, enabling students to acquire job opportunities in financial consulting companies and sectors based on banking, investment, and consumer finance.

Table of Contents

- About MBA Financial Management Course

- Eligibility Criteria for MBA Financial Management

- Why Choose MBA Financial Management Course?

- How To Get Admission for MBA Financial Management?

- Popular MBA Financial Management Entrance Exams

- MBA Financial Management Cutoff 2023

- Top MBA in Financial Management Colleges in India

- Types of MBA Financial Management Courses

- MBA Financial Management Syllabus and Subjects

- MBA in Financial Management vs MBA in Banking and Finance

- Courses After MBA in Financial Management

- Salary of an MBA Financial Management Graduate

- Career Options After MBA Financial Management Graduation

- MBA in Financial Management Scholarships

- Skills That Make You The Best MBA Financial Management Graduate

MBA Financial Management Course Details

| Degree | Masters |

| Full Form | Master of Business Administration in Financial Management |

| Duration | 2 Years |

| Age | No specific age limit |

| Entrance Exam | CAT, MAT, XAT, GMAT |

| Minimum Percentage | 50% marks in Bachelor’s studies for the general category, 45-50% for the reserved category |

| Average Fees | ₹3 - 10 LPA |

| Similar Options of Study | MBA (Finance), MBA (Systems Management), MBA (Retail Management) etc. |

| Average Salary | INR 2.5 - 20 LPA [Source: PayScale] |

| Employment Roles | Financial Analyst, Operations Manager, Business Analyst, Account Executive, Finance Manager, Senior Business Analyst, ERP Consultant, Management Consultant, Financial Advisor etc. |

| Top Recruiters | BNY Mellon, Citibank, Tesco HSC, J.P. Morgan Chase & Co, Ernst & Young, PwC, Morgan & Stanley, HSBC |

About MBA Financial Management Course

MBA FM full form stands for Master of Business Administration in Financial Management, a postgraduate degree offered in various public and private institutes in India and falls under the umbrella of the MBA course. The syllabus includes research on analytics, budgeting, and economic monitoring along with essential principles of economic analysis, accounting, control accounting, and its influences on decision-making.

Corporate Finance, Private Banking, and Consulting-related industries are always looking out for MBA Financial Management graduates. As a result, after completing this course, students will have several work opportunities with an average salary of INR 2.5 - 20 LPA.

Eligibility Criteria for MBA Financial Management

Students must meet the minimum eligibility criteria for admission to MBA Financial Management. These criteria are subject to change according to the academic structure. The general requirements for MBA Financial Management eligibility are as follows:

- Candidates under the general category must complete a 3-year bachelor's degree in any discipline from a recognized university. Students from BBA, BCom, and BA can have preferences in terms of grasping the course outcomes effectively.

- Reserved candidates are eligible for a 5% relaxation in the bachelor's degree.

- Students must pass standard MBA entrance exams such as CAT, MAT, XAT, CMAT, etc following selection through GD, PI sessions, or aptitude tests.

- This course has no age limit. However, students mostly pursue the course between the age of 22 to 25 years.

Why Choose MBA Financial Management Course?

Students who decide to pursue the program should review the MBA Financial Management course details to ensure the course outcomes. The following pointers represent the benefits of pursuing the course:

- Industry-Relevant Curriculum: The MBA Financial Management course includes knowledge of investments and raising capital, financial analysis, and managing accounts which is an integral part of the economic world today.

- Job Opportunities: Graduates who complete this course can work in a variety of finance-based industries such as banks, investment companies, insurance companies, real estate firms, etc. Students also work in many other areas such as healthcare, educational sectors, and so on.

- Demand: MBA Financial Management is a great career choice for those with a lot of imagination and ideas. MBA Financial Management degree is continually in high demand among Financial Advisors, Stock Traders, and Hedge Fund Managers.

- Career Growth: MBA Financial Management graduates have a wide range of job opportunities. Candidates can advance in their careers after gaining experience and also opt for higher education.

- Skill Development: Students get a lot of opportunities in enhancing their financial management and business skills that are required today.

Also, Check: Top Reasons to Pursue an MBA

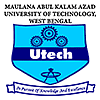

How To Get Admission for MBA Financial Management?

Admission to the MBA Financial Management program is either merit-based along with qualifying MBA Entrance exams. Though the MBA Financial Management admission process varies from college to college, below are the steps that one should generally go through to get admission.

- Step 1: Most institutions have shifted their admission procedures completely online. Therefore, students should go to the official websites of the universities they are applying to. Students can also enroll offline at the university of their choice by visiting the admission desk.

- Step 2: A candidate's performance on a National, State, or College-level entrance exam determines their potentiality to get admission to the course. Some colleges conduct their own entrance exams for the admission process.

- Step 3: Once candidates are qualified, additional admission levels vary from college to college. However, the final selection is based on previous academic performance, entrance exam scores along with qualifying GD/PI sessions or aptitude tests.

- Step 4: Shortlisted candidates need to appear for the document verification process along with paying the admission fees.

- Step 5: Students might get asked to join preparatory classes before the commencement of classes.

Read More on MBA Admission Process

Popular MBA Financial Management Entrance Exams

Most MBA in Financial Management colleges require the candidates to pass the entrance exams to be admitted to the academic program. These entrance exams are being administered at the state and national levels. The minimum grades required for the entrance exam are set at the discretion of the examining institute. Below are some of the most popular MBA Financial Management entrance exams along with important dates and registration details:

National Level MBA Financial Management Entrance Exams

The following are some of the popular MBA entrance exams that are conducted at the national level for admission to MBA FM courses.

|

MBA Entrance Exams |

Tentative Registration Date |

Accepting Colleges |

Exam Registration Details |

|

Aug 2 -Sep 13, 2023 |

SPJIMR, IIM B, IIM C, KJSI, LBSIM, Christ University |

||

|

Aug 17 - Sep 14, 2023 |

KJSI, NIBM, GNLU, Christ University |

||

|

Jul 15 - Nov 30, 2023 |

XISS, Christ University, LBSIM, KJSI, NIBM |

||

|

Aug 1 - Oct 10, 2023 |

KJSI |

||

|

February 2024 - March 2024 |

Christ University, KJSI, NIBM, XISS |

||

|

Aug 29, 2023 |

BIM, LBSIM, KJSI |

State-Level MBA Financial Management Entrance Exams

A candidate who wishes to pursue an MBA Financial Management program can get admission to the university of their choice by qualifying for specific state-level entrance tests. A list of state-level MBA entrance exams is shown below:

|

MBA Entrance Exams |

Tentative Registration Date |

Accepting Colleges |

Exam Registration Details |

|

Feb 5 - Feb 24, 2024 |

BIM |

||

|

Dec 8, 2023 - Feb 6, 2024 |

Taxila Business School, Christ University |

||

|

February 2024 - March 2024 |

PIBM, Pune |

MBA Financial Management Cutoff 2023

The cut-off marks for MBA in Financial Management in India are determined by the number of seats available and the administrative decision to enroll students. The MBA Financial Management cutoff is determined by the number of applicants and their entrance examination scores, which vary by institution. The following is a list of some of the most important MBA entrance examinations and their cut-offs:

CAT Cutoff for MBA Financial Management

The Common Admission Test, or CAT, is a computer-based exam offered by the Indian Institute of Management. The CAT score is the minimum criterion for admission to the MBA Finance program. The following are the expected CAT cutoffs 2023 (General Category) for several top universities offering MBA in Financial Management:

|

Name of the College |

Expected CAT Cutoff (Percentile) |

|

SPJIMR, Mumbai |

80+ |

|

IIM, Bangalore |

85-90 |

|

IIM, Calcutta |

88-90 |

|

LBSIM, Delhi |

85+ |

|

K J Somaiya Institute |

83+ |

XAT Cutoff for MBA Financial Management

The Xavier Aptitude Test is another prominent management entrance for admission to the top MBA colleges across the country. The general category XAT 2023 cutoff for the MBA Financial Management course is as follows:

|

Name of the College |

Expected MAT Cutoff (Percentile) |

|

XISS |

35+ |

|

Christ University |

60+ |

|

LBSIM, Delhi |

80+ |

|

NIBM, Pune |

75+ |

|

K J Somaiya Institute |

70+ |

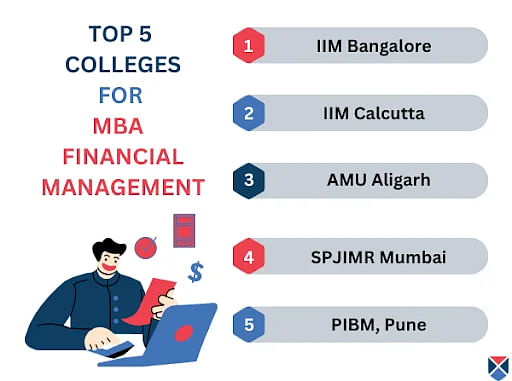

Top MBA in Financial Management Colleges in India

India is home to some of the best MBA in Financial Management colleges for aspirants. Candidates have many options to choose from in terms of the best MBA Financial Management course as per their preferences. Depending on the type of MBA Financial Management programs offered, candidates will have to make the appropriate choice.

Top MBA Financial Management Government Colleges

Several top government colleges are offering quality MBA Financial Management programs across the country. Check the table below for the top government-based MBA Financial Management colleges in India:

|

Institution |

Average Fees |

|

INR 12 LPA |

|

|

INR 10.5 LPA |

|

|

INR 3 LPA |

|

|

INR 51,500 PA |

|

|

INR 1.8 LPA |

Top MBA Financial Management Private Colleges

India has seen significant growth in the number of quality MBA Financial Management private colleges that offer some of the best programs in the country. Check the table below for the top MBA Financial Management private colleges in India:

|

Institution |

Average Fees |

|

INR 10 LPA |

|

|

INR 3.75 LPA |

|

|

INR 2.5 LPA |

|

|

INR 6 LPA |

|

|

INR 7.2 LPA |

|

|

INR 3.37 LPA |

|

|

INR 10 LPA |

|

|

INR 6.8 LPA |

Types of MBA Financial Management Courses

MBA Financial Management courses are available in a range of options. Students can pursue this course based on their choice and preferred career growth. Below are the types of MBA Financial Management courses in detail:

|

Type |

Eligibility |

Course Duration |

|

MBA in Financial Management (Full Time) |

|

2 Years |

|

Executive MBA in Financial Management |

|

1-2 Years |

|

Online MBA in Financial Management |

|

2 Years |

Executive MBA Financial Management

The Executive MBA Financial Management course is designed with flexibility for working professionals and students who cannot attend regular classes. Some of the pointers regarding Executive MBA FM are given below:

- The Executive MBA Financial Management course duration is 1-2 years depending on the academic structure.

- The average course fees for EMBA in Financial Management range between INR 40,000-2,25,000 LPA.

- Candidates might require certain work experience.

- IIM Calcutta is known for its academic excellence and provides an executive program based on financial management.

- Mewar University also provides EMBA in Financial Management along with PGP certification.

Online MBA Financial Management

For those who wish to pursue an MBA Financial Management course after their bachelor’s degree but don't have the time to attend normal classes, owing to jobs or personal endeavors, distance learning is the ideal option. Some of the pointers regarding Online MBA FM are given below:

- MBA Financial Management distance learning course usually lasts 3 years and is divided into four semesters of six months each.

- Colleges such as DY Patil University and NMIMS provide MBA in Financial Management.

City-Wise MBA in Financial Management Colleges

MBA Financial Management Syllabus and Subjects

The MBA Financial Management course is designed to give students both a theoretical and practical study approach. Students can successfully learn the abilities required in the finance industry. The MBA Financial Management course follows a set pattern. The following is a list of the general topics that will be covered during the MBA FM course:

|

Subjects |

Topics Covered |

|

Principles of Accounting |

Accrual Principle, Consistency Principle, Cost Principle, Matching Principle, Revenue Recognition Principle |

|

Business Law |

Employment Law, Corporate Law, Contract Law, Intellectual Property Law, Commercial Transactions, Consumer Protection Laws |

|

Corporate Financial Reporting and Analysis |

Collecting and Tracking Data, Revenues, Expenses, Profits, Capital, Cash Flow, Balance Sheet, Income Statement |

|

Quantitative Analysis of Financial Decisions |

Derivative Structuring or Pricing, Risk Management, Investment Management, Mathematical and Statistical Modeling |

|

Financial Accounting and Analysis |

Balance Sheet Creation, Balance Sheet Analysis, Cash Flow Statements, Traditional Accounting, Financial Statement Analysis |

Read More: MBA Financial Management Syllabus and Subjects

MBA in Financial Management vs MBA in Banking and Finance

Master of Business Administration in Financial Management mainly includes studies based on strategic financing and finance management. MBA in Banking & Finance on the other hand encompasses holistic knowledge of banking principles and management along with in-depth study of finance, economics, and accounting.

The table below showcases the differences between MBA FM and MBA in Banking & Finance:

|

Course |

MBA Financial Management |

MBA in Banking and Finance |

|

Full-Form |

Master of Business Administration Financial Management |

Master of Business Administration in Banking and Finance |

|

Stream |

Management |

Management |

|

Course Duration |

2 years |

2 years |

|

Eligibility |

10+2 from a recognized board with a minimum of 50% and a bachelor’s degree from a recognized university. |

Bachelor’s degree with a minimum of 50-55% marks |

|

Entrance Exams |

CAT, MAT, GMAT, etc |

CAT, GMAT, XAT |

|

Top Colleges |

SP Jain University, ISB Hyderabad, IIM A, IIT Delhi, IIM B |

IIBF, Utkal University, RIMT, Jain University, SRMU |

|

Fees |

INR 2 - 14 LPA |

INR 35,000 - 5 LPA |

Read More: MBA Finance

Courses After MBA in Financial Management

There are plenty of courses that students can pursue upon the completion of an MBA Financial Management course as the module equips students with foundational knowledge and advanced insights of budgeting and forecasting. Students can also enroll in certification courses for career development. Some of the top courses that students choose after completing MBA FM are given below:

Salary of an MBA Financial Management Graduate

The average salary for MBA Financial Management graduates varies depending on the specialization chosen by the candidates. Graduates can increase their salary by getting more work experience. The average MBA Financial Management job starting salary for MBA financial management graduates is around INR 2.5 - 20 LPA [Source: PayScale]. The following table includes job designations after Financial Management in MBA along with the average salary package:

|

Job Role |

Average Starting Salary |

Average Salary with Experience |

|

Financial Analyst |

INR 5 LPA |

INR 11 LPA |

|

Risk Manager |

INR 6 LPA |

INR 30 LPA |

|

Insurance Manager |

INR 1.5 LPA |

INR 10 LPA |

|

Accounting Manager |

INR 5 LPA |

INR 20 LPA |

[Source: Payscale & Glassdoor]

Read More: MBA Financial Management Salary

Career Options After MBA Financial Management Graduation

There are plenty of jobs available for MBA Financial Management students in both the public and private sectors. The job roles will differ based on the specialization that one has opted for. There are abundant MBA FM job opportunities with good salary packages that include the following job profiles:

| Job Designations | Job Description |

|

Financial Analyst |

Assist in creating project budgets and anticipates future revenue and expenses along with analyzing and generating reports on financial data, as well as monitoring financial developments in the market. |

|

Risk Manager |

Monitoring complete insurance and risk management program in an organization and also examining & identifying risks that can compromise the company's reputation, safety, security, or financial success. |

|

Investment Banking Associates |

Create cash flow models, develop communications with clients and investors, and provide clients with support services. |

|

Cash Manager |

Implementing monetary policies, managing payroll and cash flow processes, supervising junior accounting staff, and helping with annual audits |

|

Credit Manager |

Managing the credit-granting process and safeguarding a company's assets along with determining the creditworthiness of potential customers, reviewing current clients, and increasing sales. |

|

Insurance Manager |

Conceive, implement, regulate, and administer the insurance provisions in a way that maximizes efficiency, performance, and best value in comparison to pre-established goals. |

| Accounting Manager | General administration and direction of the accounting department by examining financial records along with applying accounting policies and processes. |

Top Recruiters for MBA in Financial Management Management Graduates

Graduates can get lucrative jobs in major MNCs, financial corporations, and firms. Below are the top recruiters that hire graduates with MBA in Financial Management.

|

Top Recruiters |

Average Salary |

|

Goldman Sachs |

INR 9 - 20 LPA |

|

Morgan Stanley |

INR 5.2 - 30 LPA |

|

JP Morgan Chase & Co |

INR 12.5 - 23 LPA |

|

Deloitte |

INR 8 - 25 LPA |

|

KPMG |

INR 13 - 25 LPA |

[Source: Payscale & Glassdoor]

MBA in Financial Management Scholarships

MBA FM students are eligible for a number of scholarships granted by private universities and government initiatives. The following is a list of scholarships available to MBA Financial Management students:

|

Scholarship |

Eligibility |

Scholarship Amount |

|

Aditya Birla Group Scholarship |

|

INR 3 Lakhs |

|

HDFC Bank ECS Scholarship |

|

INR 75,000 |

|

Mahatma Gandhi Scholarship |

|

INR 12 - 14 Lakhs (Depending on the course) |

|

Gaurav Foundation Scholarship |

|

INR 4 Lakhs |

|

IDFC First Bank MBA Scholarships |

|

INR 2 Lakhs |

Skills That Make You The Best MBA Financial Management Graduate

As financial management is used by all industries in this age, aspirants apply to transform themselves from wannabe brutes into wannabe financial management professionals. Some of the skills MBA students in Financial Management must have:

- Logical Reasoning - Logical Reasoning abilities assist applicants in enhancing their decision-making, problem-solving, and goal-setting abilities.

- Cash Flow Analysis - An important function in finance, cash flow analysis assists in determining a firm's working capital, which is critical for business operations.

- Numerical Aptitude - A candidate with a strong numerical aptitude can easily execute complex calculations, understand and analyze numbers, and interpret data.

- Financial Reporting - Financial reporting is necessary for management to make rational business decisions based on the financial health of the organization.

- Accounting Knowledge - A good knowledge of accounting assists students in understanding and evaluating the financial information involved in the development, operation, and maintenance of a corporation.

- Business Intelligence - One of the most significant skills is the ability to come up with unique solutions to specific business circumstances and challenges by analyzing data.

- Industry-Specific Knowledge - It enables students to keep awareness about ongoing business trends and changes for adequate career growth.

Top MBA Financial Management Colleges

Top Management Entrance Exams

MBA Financial Management Fee Structure

FAQs on MBA Financial Management

Q: How does the MBA financial management curriculum differ from the CFA level 1 curriculum?

Q: Is Maths compulsory for MBA Financial Management?

Q: What certificate courses can be done after MBA in Financial Management?

Q: What is the average salary of an MBA Financial Management graduate?

Q: What are the average fees for the MBA Financial Management course?