MBA in Banking: Course Details, Eligibility, Admission, Fees

MBA in Banking is a 2-year postgraduate degree that focuses on developing the administrative and management knowledge of banking aspirants, with a focus on banking services, legal compliance, portfolio management, financial & strategic planning, etc. The fee for this course ranges from INR 12,500 - 5.3 LPA. Students must have a minimum of 50% marks in an undergraduate degree in any discipline from a recognized University Board, with a 5% relaxation given to SC/ST/OBC candidates, to gain admission into this course.

Students gain admission to MBA in Banking through management entrance exams such as XAT, CAT, MAT, CMAT, etc. Once students qualify for the minimum cut-offs, they move forward to personality assessment rounds such as the GD + PI. The average salary for a fresh MBA BAnking graduate ranges from INR 3 - 7 LPA. MBA in Banking is a specialized degree under the MBA course.

Table of Contents

- About MBA in Banking

- MBA in Banking Eligibility Criteria

- Why Choose MBA in Banking Course?

- MBA in Banking Admissions 2023

- MBA in Banking Entrance Examinations

- Top MBA in Banking Colleges in India with Fee Details

- Types of MBA in Banking Courses

- Syllabus and Subjects for MBA in Banking

- MBA in Banking vs. MBA in Finance Course Comparison

- Courses After MBA in Banking

- Salary of an MBA in Banking Graduate In India

- Career Options After MBA in Banking

- Skills to Excel as MBA in Banking Graduate

- Preparation Tips for MBA in Banking Course

MBA in Banking Course Details

| Degree | Masters |

| Full Form | Master of Business Administration in Banking |

| Duration | 2 Years |

| Age | No age limit |

| Entrance Exam | Management Entrance Exams such as CAT, XAT, MAT, GMAT |

| Subjects Required | Any subjects in an Undergraduate Degree |

| Minimum Percentage | For the unreserved category, a minimum of 50% aggregate in UG degree or as specified by the University is required. A 5% relaxation is given to SC/ST/OBC candidates. |

| Average Fees | ₹3 - 24 LPA |

| Average Salary | INR 3 - 7 LPA (Source: AmbitionBox) |

| Employment Roles | Bank Manager, Budget Analyst, Portfolio Manager, Investment Banker, Credit Manager, Wealth Manager, etc. |

| Top Recruiters | Wells Fargo, EY, KPMG, TCS, HDFC, ICICI, Axis, Morgan Stanley |

About MBA in Banking

MBA in Banking full form is Master of Business Administration in Banking. It is typically a postgraduate course of 2 years, providing students with a chance to expand their knowledge of management and administrative processes within a bank, with a focus on financial planning, banking services for customers, the dynamism of the share market, and relevant aspects of the sector in an evolving business environment. MBA in Banking is a specialization degree under MBA course.

NMIMS, Manipal University, Pondicherry University, Jain University, Amity University, Alagappa University, Bharathiar University, and IGNOU University are some great colleges to pursue an MBA in Banking. A final degree in MBA in Banking from these reputed colleges will provide the students with promising careers in the Banking & Financial services sector, such as private or government banks, consultancies, etc.

MBA in Banking Eligibility Criteria

MBA in Banking admission processes are based on the student’s eligibility status such as the minimum percentage in an undergraduate degree, work experience, qualifying minimum cut-offs of entrance exams, etc. Aspirants aiming for MBA in Banking must fulfill the following requirements to be eligible for MBA in Banking Admissions:

- In some cases, preference may be given to students with a Bachelor of Business Administration (BBA) degree.

- A minimum 50% aggregate score in an undergraduate degree from any recognised University. A 5% relaxation is given to SC/ST/OBC candidates in the reserved category.

- Aspirants must clear important management entrance exams like GMAT, CAT, CMAT, XAT, MAT, etc. to sit further for MBA in Banking admissions.

- Note that some colleges prefer students with work experience of one or two years. Please check college-specific requirements before applying.

Why Choose MBA in Banking Course?

Many students looking to begin their career in Banking Services and Financing seek courses such as an MBA in Banking degree. The reasons for this are stated below:

- Vast career opportunities exist for students graduating with an MBA in Banking degree, with job roles in the private and public sectors.

- Comprehensive learning: MBA in Banking students will acquire in-depth learning on industry-relevant topics such as Stock Market, Investments, Financial Management, Resource Planning, Credit, Risk Management, Banking Processes, etc.

- Lucrative Salary Packages: An MBA in Banking graduate can earn an average salary of INR 3 - 7 LPA. This range of average salary appreciates with time and work experience.

- Ample job opportunities: MBA in Banking graduates can take up a variety of employment roles, such as Credit Manager, Bank Manager, Budget Analyst, Portfolio Manager, Financial Consultant, Wealth Manager, etc.

- Market Value: Since a lot of organizations seek financial experts, having an MBA in Banking degree can elevate a graduate's perceived marketability for employment.

MBA in Banking Admissions 2023

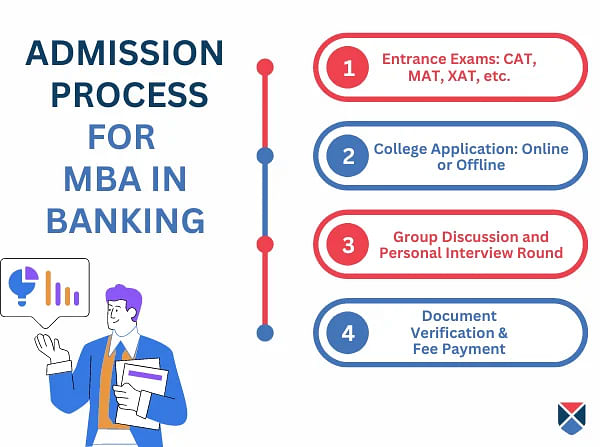

Admissions for MBA in Banking 2023 course rest on the scores of entrance examinations. While some colleges hold their own set of entrance examinations for admissions, some prefer national management entrance examinations. In either case, qualifying through minimum cut-offs is an imperative requirement for MBA in Banking admission.

The admission process for MBA in Banking is listed below:

- Step 1: Students must register for their preferred college through online mode or offline mode.

- Step 2: A common requirement for most management colleges is management entrance exams such as GMAT, CAT, XAT, CMAT, etc.

- Step 3: Once entrance exam results have been announced, clearing the minimum cut-offs is the next step to getting admission into MBA in Banking courses.

- Step 4: Once students qualify for all the previous requirements, they must pay the admission fee and sit for GD + PI + Counseling sessions. Counseling sessions are a great opportunity for students to familiarise themselves with the college and course aspects.

- Step 5: Post Admissions into MBA in Banking course, students are required to finish certain formalities, such as submitting documents, previous degree certificates, IDs, letters, etc.

MBA in Banking Entrance Examinations

Most colleges that offer MBA in Banking degrees require that students clear the minimum cut-offs for entrance exams. Students must ensure proper preparation for the exam course and dedicate a respectable amount of time to revising the syllabus for the entrance exam.

The most important entrance exams for MBA in Banking are mentioned below. The tentative registration dates and colleges that accept these exams are also listed for students’ convenience:

| Entrance Exams | Tentative Registration Dates | Accepting Colleges |

| CAT | Aug 2 -Sep 13, 2023 | NMIMS |

| MAT | Aug 17 - Sep 14, 2023 | Amity School of Banking & Finance |

| XAT | Jul 15 - Nov 30, 2023 | SRS University |

| CMAT | February 2024 | Jain University |

| KMAT | Jan 20, 2024 | Alliance University, Manipal University |

| GMAT | Aug 29, 2023 | NMIMS |

Top MBA in Banking Colleges in India with Fee Details

MBA in Banking syllabus expands on the management principles within the banking sector and teaches students to make financial decisions considering credit scores, the global share market, and future predictability within an economic context. Students must consider resources, facilities, infrastructure, etc. offered while picking a college.

The fee structure for MBA in Banking fluctuates, with private institutions such as Manipal (TAPMI) or NMIMS having a higher fee structure but government institutions such as IGNOU or Pondicherry University having lower fees.

The average MBA in Banking course fees range between INR 12,500 to 5.3 LPA.

Some reputed colleges that offer MBA in Banking degrees across India are listed for convenience:

| NIRF Management Ranking 2023 | Name of the Institute | Average Annual Fee (INR) |

| 21 | NMIMS | 96,000 PA |

| - | Symbiosis School of Banking & Finance | 5.3 LPA |

| - | Pondicherry University | 12,500 PA |

| 42 | Manipal University (TAPMI) | 3 LPA |

| 28 | Amity University | 2.04 LPA |

| 82 | Panjab University | 2.5 LPA |

| 64 | Chitkara University | 1.3 LPA |

| - | SRM University | 4 LPA |

| 36 | Chandigarh University | 2.5 LPA |

| - | IGNOU University | 32, 000 PA |

| - | Alagappa University | 12, 850 PA |

| - | Bharathiar University | 40,425 PA |

Types of MBA in Banking Courses

The need for different modes of learning through the pandemic has necessitated colleges to introduce more options for distance and part-time learning. MBA in Banking has always been a coveted degree to hold, and with colleges offering convenient forms of learning, students have been able to gain an education. Such flexible modes of learning motivate students to balance their commitments while being able to work toward a professional degree conveniently.

Let’s take a look at the different types of MBA in Banking courses:

| Type | Colleges Offering | Eligibility | Duration of Course |

| Full-time MBA in Banking | Amity, Chandigarh University, Pondicherry University, Manipal University | Candidates must have a minimum 50% aggregate in UG Degree. A 5% relaxation is given to SC/ST/OBC candidates. | 2 Years |

| Part-time MBA in Banking | D Y Patil University, IGNOU | Candidates must have a 50% minimum aggregate in UG Degree. A 5% relaxation is given to SC/ST/OBC candidates. | 3 Years |

| MBA in Banking Distance Learning | NMIMS | Candidates must have a 50% minimum aggregate in UG Degree. A 5% relaxation is given to SC/ST/OBC candidates. | 2 Years |

Syllabus and Subjects for MBA in Banking

Like most Masters's courses, MBA in Banking syllabus also involves two types of subjects - core, and electives. These subjects are disseminated over 4 semesters of 2 years and require students to study core (mandatory) subjects as well as choose specialized electives of their liking and interests. Some of the essential MBA Banking subjects have been mentioned below:

| Subjects | Topics Covered |

| Financial Management | Scope & Objectives, Profil Maximization, Financial Planning & Forecasting, Financing Decision, Investment Decisions, Dividends - Meaning & Significance, Working Capital Decision |

| Financial Markets & Services | Structure of Financial System, Financial Services: Concept, Nature, Scope, Venture Capital, Credit Rating: Functions, Mutual Funds - Concept, Functions, Portfolio Classification, Debt Securitization |

| Rural Banking | Rural India: Demographic Features, Financing Rural Development, RBI, NABARD, Financial Inclusion: Concept & Role in Inclusive Growth, Priority Sector Financing & Govt. Initiatives, Problems & Prospects of Rural Banking |

| Retail Banking | Concept of Retail Banking, Important Retail Asset Products: Home Loans, Auto Loans, Personal Loans, Education Loans, Eligibility, Retail Strategies: Delivery Channels, ATMs, POS, Internet Banking, Trends in Retailing, Recovery of Retail Loans, Recovery Process, DRT Act, SARAFAESI Act |

| Foreign Trade | Foreign Trade: Need, Meaning, Exchange Controls - Meaning, Methods, Import Finance, Project Exports, Role of Commercial Banks and EXIM Bank of India in Financing India’s Foreign Trade |

MBA in Banking vs. MBA in Finance Course Comparison

MBA in Finance is a management course that focuses on the broader context of an economy and the fundamental concept related to it, while an MBA in Banking has a more focused spotlight on banking services, investments, financial channels, etc.

Let us look at the differences between MBA in Banking and MBA in Finance in the table below:

| Course | MBA Banking | MBA Finance |

| Full Form | Masters of Business Administration in Banking | Masters of Business Administration in Finance |

| Stream | Management | Management |

| Course Duration | 2 Years | 2 Years |

| Eligibility | Bachelor’s degree from a recognized college/university | Bachelor’s degree from a recognized college/university |

| Entrance Exams | CAT, XAT, MAT, etc. | CAT, GMAT, CMAT, etc. |

| Top Colleges | Manipal, Pondicherry University, NMIMS, etc. | IIM, Bits Pilani, MDU etc. |

| Fees | INR 12,500 - 5.3 LPA | INR 2 - 10 LPA |

Courses After MBA in Banking

Students are always looking to strengthen their knowledge and skill sets, and higher studies are a suitable option after MBA Banking for them. Adding onto previous knowledge not only supplements career prospects, but also enhances practical know-how through interaction with various points of contact, such as professors, peers, field experts, mentorship sessions, etc. Students have different avenues to conduct research, gain experience, and acquire in-depth knowledge with higher education opportunities in MBA Banking.

Some important courses for higher studies after MBA in Banking are:

- M.Tech in Banking

- M.Sc in Banking

- Specialized courses in Financial Risk Management, Investment Banking, etc.

- A 2nd MBA in any other stream

- Chartered Accountant (CA) Courses

- Executive MBA courses

- Ph.D. in a related field

Salary of an MBA in Banking Graduate In India

The field of banking services is always in need of individuals with a strong head, conviction to deal with sudden changes and forethought for forecasting financial slumps. MBA in Banking courses prepare individuals with relevant knowledge and strong qualities that most organizations look for. MBA in Banking salary on average for fresh graduates ranges from INR 3 to 7 LPA. With increasing duration and gaining experience, salaries also climb up.

Some relevant organizations that hire MBA Banking graduates are Banking Firms (private and government), Asset Management companies, Accounting firms, etc. Top recruiters are HDFC Bank, ICICI Bank, Microsoft, EY, SBI, HSBC, KPMG, etc.

Here are some job roles and their corresponding entry-level salary for MBA in Banking graduates:

| Job Roles | Average Annual Entry-Level Salary (INR) |

| Bank Manager | INR 4 LPA |

| Investment Banker | INR 5 LPA |

| Portfolio Manager | INR 7 LPA |

| Wealth Manager | INR 3 LPA |

| Credit Manager | INR 6 LPA |

| Budget Analyst | INR 5.8 LPA |

| Financial Analyst | INR 4 LPA |

Career Options After MBA in Banking

MBA in Banking is replete with various job roles and career prospects. Career options in banking and financial services are provided by highly reputable companies such as KPMG, HDFC, SBI, Morgan Stanley, Goldman Sachs, Barclay’s, etc. These highly sought-after companies with their lucrative pay packages are constantly looking for individuals with a background in MBA in Banking.

Let’s take a close look at some of the job roles that MBA in Banking graduates can take up:

| Employment Roles | Job Description | Top Recruiters | Average Annual Salary (INR) |

| Bank Manager | Responsible for recruiting and training staff. Monitoring staff performance and motivating performance management systems. Establishing and handling grievance redressal systems in the organization. | ICICI Bank, HDFC Bank, Axis Bank | INR 7 LPA |

| Investment Banker | Tasked with raising capital for individuals and companies through debt & equity selling. Handling aspects related to Mergers & Acquisitions for clients. Discovering client-specific investment opportunities for risk and returns. | JP Morgan Chase, Morgan Stanley, Goldman Sachs | INR 8 LPA |

| Portfolio Manager | Responsible for handling the existing investment money and other investment portfolios of a client. | Wells Fargo, Capgemini, Tata Consultancy Services | INR 7.5 LPA |

| Wealth Manager | Tasked with planning investments and finances of high-net-worth clients to meet specific financial goals. Offer services such as portfolio management, estate planning, taxation, audits, etc. | Kotak, Standard Chartered Bank, Aditya Birla Finances | INR 7 LPA |

| Credit Manager | Credit managers monitor clients’ credit aspects, such as credit scores, lending money through credit, and interest rates. They also advise clients on how to reduce debt loss, approve or reject loan requests, etc. | Citi Bank, HDFC, American Express, ICICI Bank | INR 6.5 LPA |

| Budget Analyst | Studying client expenditures v/s approved budget limitations, and approving spending. Also tasked with estimating future needs of the client accordingly. | EY, Bictree, KPMG | INR 6 LPA |

| Financial Analyst | Collecting and analyzing financial data of an organization to produce recommendations that are based on reducing costs and improving financial gains through investments. Oftentimes work with Budget Analysts hand in hand. | Accenture, Deloitte, Amazon, TCS | INR 4.5 LPA |

Skills to Excel as MBA in Banking Graduate

As the dynamic industry of banking and financial services rests on customer service, field workers must know how to maintain relationships with clients effectively. MBA in Banking course gives students a chance to explore several career options such as Bank Managers, Financial Analysts, Budget Analysts, Wealth Managers, Investment Bankers, etc. Some critical skills required for an MBA Banking course are:

- Financial Reporting - Bankers must be proficient in monitoring all the flow of finances coming in and out of a business to ensure transparency with stakeholders. The ability to track and provide liabilities and assets through financial reports keeps the process of money exchange simple and quick.

- Customer Satisfaction - Building a rapport with customers and empathizing with them to understand their needs and serve them accordingly is an incumbent part of retaining and improving business.

- Numeracy skills - A basic understanding of mathematics facilitates analysis of upcoming market trends, and analyzing these trends and numbers is a fast technique for predicting future risks and challenges.

- Commercial Awareness - Professionals need to combine all the previously mentioned skills and current business trends to optimize forecasting and business development plans by analyzing the current corporate climate.

- Upselling - The ability to identify a gap in the needs of a customer and fulfill that gap through upselling ensures bankers meet their targets while also providing a holistically wholesome experience for customers.

Preparation Tips for MBA in Banking Course

- Right-fit: There are scores of colleges offering MBA in Banking courses. However, you must decide if the college you have picked satisfies your criteria, whether it be exposure, real-world knowledge, peer-to-peer interactions, facilities, infrastructure, etc.

- Interact with field members: Network and speak to field-related field experts, professors, alumni, etc. to learn more about the real-world implications of a course like an MBA in Banking. Look out for networking opportunities on LinkedIn or contact them via the official college website. Most educators do not hesitate before helping out prospective students.

- In some cases, obtaining prior work experience of a year or two in the relevant industry you’re studying for may assist your Admissions process and understanding of the subject.

- Try to find sample course papers, research papers, and study materials to prepare yourself for the course curriculum.

- MBA in Banking admission can be a competitive process. Try early preparation for your application process to gain an advantage over others.

Top MBA in Banking Colleges

Top Management Entrance Exams

MBA in Banking Fee Structure

FAQs on MBA in Banking

Q: Which type of MBA is best for banking careers?

Q: Is an MBA useful in Banking?

Q: What is the salary for Banking after MBA?

Q: What is the scope of an MBA in Banking course?

Q: What is the average MBA Banking course fee?

Q: What are the best colleges for MBA in Banking?