Table of Contents

CUET Accountancy syllabus 2025 comprises topics like Accounting Not-for-Profit Organisation, Accounting for Partnership, Computerised Accounting System, etc. The complete syllabus of CUET Accountancy is divided into 11 units and covers topics from class 12.

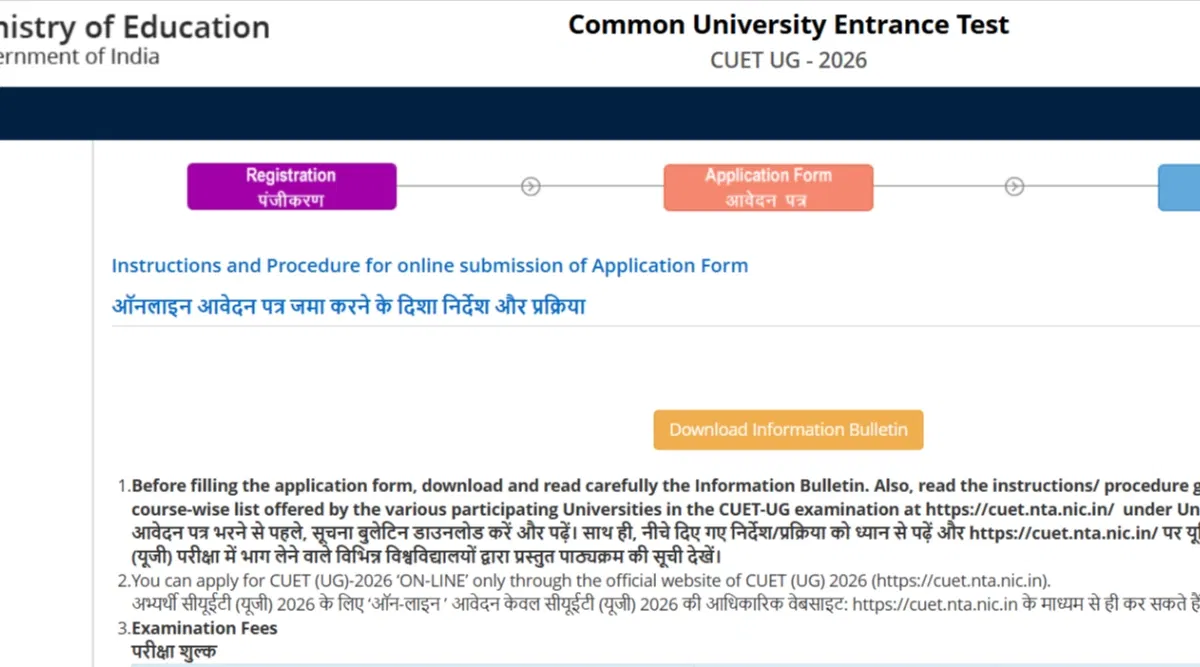

The updated CUET Accountancy syllabus has been released by NTA, and students can download the same in PDF form to ace the exam preparation. Further, National Testing Agency (NTA) is the conducting authority of the CUET exam every year. Furthermore, applicants are advised to appear for CUET mock tests for an effective outcome.

CUET Accountancy Syllabus 2025 PDF Download

Candidates have been provided the official PDF download link for CUET Accountancy syllabus 2025. This is done so that applicants can refer to the syllabus PDF whenever they require it at their convenience.

| Particulars | Direct Link |

| CUET Accountancy Syllabus PDF | Download Here |

CUET Accountancy Syllabus 2025

The 11 units of the CUET Accountancy syllabus 2025 cover various topics as listed below. The syllabus mostly covers topics from the class XII syllabus.

Accounting for Not-for-Profit Organizations and Partnership Firms

The first part of the CUET Accountancy syllabus is 2025 is Accounting for Not-for-Profit Organizations and Partnership Firms, which involves the following units and topics.

- Accounting Not-for-Profit Organisation

- Not-for-profit organization

- Receipts and Payments

- Preparation of Income and Expenditure Account and Balance sheet from receipt and payment account with additional information.

- Accounting for Partnership

- Nature of Partnership Firm

- Final Accounts of Partnership

- Reconstitution of Partnership

- Changes in profit sharing ratio among the existing partners – Sacrificing ratio and Gaining ratio.

- Accounting for Revaluation of Assets and Liabilities and Distribution of reserves and accumulated profits.

- Goodwill: Nature, Factors affecting and Methods of valuation: Average profit, Super profit, Multiplier, and Capitalization methods.

- Admission of a Partner: Effect of admission of a partner, Change in profit sharing ratio, the Accounting treatment for goodwill, Revaluation of assets and liabilities, Reserves (accumulated profits), and Adjustment of capital.

- Retirement/Death of a Partner: Change in profit sharing ratio, Accounting treatment of goodwill, Revaluation of assets and liabilities, Adjustment of accumulated profits (Reserves).

- Dissolution of Partnership Firm

- Meaning, Settlement of accounts: Preparation of realization account and related accounts (excluding piecemeal distribution, sale to a company and insolvency of a Partner)

- Company Accounts and Financial Statement Analysis.

- Accounting for Share and Debenture Capital

- Share Capital: Meaning, Nature and Types.

- Accounting for Share Capital: Issue and Allotment of Equity and Preference Shares; Oversubscription and Under subscription; Issue at par, premium and at discount; Calls in advance, Calls in arrears, Issue of shares for consideration other than cash.

- Forfeiture of Shares: Accounting treatment, Re-issue of forfeited shares.

- Presentation of shares and Debentures Capital in the company’s balance sheet.

- Issue of Debenture – At par, premium, and discount; Issue of debentures for consideration other than cash.

- Redemption of the debenture.

- Out of proceeds of fresh issue, accumulated profits, and sinking fund.

- Analysis of Financial Statements

- Financial Statements of a Company: Preparation of simple financial statements of a company in the prescribed form with major headings only.

- Financial Analysis: Meaning, Significance, Purpose, Limitations.

- Tools for Financial Analysis: Comparative statements, Common size statements.

- Accounting Ratios: Meaning and Objectives, Types of ratios: Liquidity Ratios: Current ratio, Liquidity ratio.

- Solvency Ratio: Debt to equity, Total assets to debt, Proprietary ratio.

- Activity Ratio: Inventory turnover, Debtors turnover, Payables turnover, Working capital turnover, fixed assets turnover, Current assets turnover.

- Profitability Ratio: Gross profit, Operating ratio, Net profit ratio, Return on Investment, Earnings per Share, Dividend per Share, Profit Earning ratio.

- Statement of Changes in Financial Position

- Cash Flow Statement: Meaning and Objectives, Preparation, Adjustments related to depreciation, dividend and tax, sale and purchase of non-current assets (as per revised standard issued by ICAI).

Computerised Accounting System

The second portion of the CUET Accountancy syllabus 2025 is Computerised Accounting System that contains the below-mentioned list of units and chapters.

- Overview of Computerised Accounting System

- Concept and Types of Computerised Accounting System (CAS).

- Features of a Computerised Accounting System.

- Structure of a Computerised Accounting System.

- Using Computerised Accounting System

- Steps in the installation of CAS, Preparation of chart of accounts, Codification, and Hierarchy of account heads.

- Data entry, Data validation, and Data verification.

- Adjusting entries, Preparation of financial statements, Closing entries, and Opening entries.

- Security of CAS and Security features are generally available in CAS (candidates are expected to understand and practice the entire accounting process using an accounting package).

- Accounting Using Database Management System (DBMS)

- Concepts of DBMS.Objects in DBMS: Tables, Queries, Forms, Reports.

- Creating data tables for accounting.

- Using queries, forms, and reports for generating accounting information. Applications of DBMS in generating accounting information such as shareholders’ records, sales reports, customers’ profiles, suppliers’ profiles payroll, employees’ profiles, and petty cash registers.

- Accounting Applications of Electronic Spreadsheet

- Concept of an Electronic Spreadsheet (ES).

- Features offered by Electronic Spreadsheet.

- Applications of Electronic Spreadsheet in generating accounting information, preparing depreciation schedules, loan repayment schedules, payroll accounting, and other such company

Best Books for CUET Accountancy Syllabus 2025

There are limited books available in the market that covers the CUET Accountancy syllabus 2025. However, here are the CUET books 2025 that will help in preparing for the exam.

| Books | Authors/ Publishers |

| Go To Guide for CUET (UG) Accountancy | Disha Experts |

| Accounting Made Easy | Rajesh Agrawal. R Srinivasan |

| Class XII Accountancy | NCERT |

CUET Accountancy Syllabus Preparation Tips

The CUET Accountancy syllabus 2025 can be covered effectively by students by following the CUET preparation 2025 given below.

- Creating a Knowledge Base: Candidates must ensure they have the fundamental information necessary to prepare for the CUET accounting syllabus 2025. Besides, they must be aware of the present syllabus. They can visit the official website of the exam or download the PDF mentioned in the article to download the syllabus PDF.

- Establish a Study Timetable: Candidates must set up a productive study routine to make the most of their efforts and maximize their time. Candidates should estimate how much time they will need to finish their projects and divide it among the various tasks to develop an efficient plan. Candidates should periodically examine and adjust their study schedules to make the best use of their time. It's crucial to account for breaks and downtime while planning your study routine. Regular breaks can keep candidates engaged and attentive while also preventing burnout. Also, it's crucial to confirm that the study timetable is doable and reasonable.

- Utilise the Resources: The CUET Accounting syllabus 2025 covers a wide range of subjects, some of which may be difficult for some candidates to understand. Candidates need to use the resources to comprehend complex ideas completely. Using the top books and study resources is part of this.

- Incorporate Effective Time Management Tips: The syllabus can be completed with careful time management. Candidates should try to pinpoint areas where they waste or use their time inefficiently, such as procrastination, social media use, or hours spent taking notes during lectures. Candidates should also make sure they take regular pauses throughout the day so they may rest, think about what they've learned, and digest it.

Also Read: Minimum Marks Required in CUET for Government Colleges

FAQs on CUET Commerce & Accountancy

Q: What is the syllabus of CUET UG Commerce and Accountancy paper?

The Commerce and Accountancy CUCET UG syllabus topics 2025 are Accounting Not-for-Profit Organization, Accounting for Partnership, Reconstitution of Partnership, Dissolution of Partnership Firm, Accounting for Share and Debenture Capital, Analysis of Financial Statements, Overview of Computerized Accounting System, Accounting Applications of Eletcronic Spreadsheet, and many more.

Q: What is the CUET Commerce and Accountancy exam pattern 2025?

In CUET the Commerce and Accountancy paper consist of 50 questions out of which 40 questions are required to be attempted by the students. The questions are asked as Mutiple Choice Questions (MCQs). Further, the exam will be commenced for 60 minutes for the Commerce and Accountancy paper and students must complete the paper within the scheduled time.

Q: Is it enough to cover NCERT books for the CUET UG Commerce and Accountancy paper?

It is true that most of the questions asked in the CUCET UG exam are asked from 12th NCERT books. Thus, preparing with the NCERT book for the CUET exam is best for students. But, candidates are advised to refer other resources whether available online or offline as NCERT is made to strengthen the basic of the students and referring other books will make them learn some new and different aspects as well.

Q: Which books are best for CUET Commerce and Accountancy paper?

While preparing for the CUET UG Commerce and Accountancy paper students must refer to the following books Go To Guide for CUET (UG) Accountancy by Disha Experts, Accounting Made Easy by Rajesh Agrawal. R Srinivasan, and Class XII Accountancy by NCERT.

Q: How can we download the CUCET UG syllabus for Commerce and Accountancy paper?

Students will be able to download the Commerce and Accountancy syllabus PDF of the CUET UG exam from the article or can refer the official website. They must go to the official website and check for the syllabus relevant link. Once get, they must click on it. The subject-wise syllabus PDFs page will be displayed on the sscreen. Students must then download the PDF of their subject.