Vidya Lakshmi education loan scheme is extended to 37 banks and 139 loan schemes. The interest rate starts from 8.40%, and the loan is up to INR 4 Lakh.

Table of Contents

- Vidya Lakshmi Education Loan Scheme

- Vidya Lakshmi Education Loan Interest Rate

- Features of Vidya Lakshmi Education Loan

- Vidya Lakshmi Education Loan Eligibility

- Student Eligibility Criteria of Vidya Lakshmi Education Loan

- How to Apply for an Education Loan?

- List of Banks Registered with Vidya Lakshmi Education Loan

- Benefits of the Vidya Lakshmi Education Loan Scheme

Vidya Lakshmi Education loan was launched under the Pradhan Mantri Vidya Lakshmi Karyakram on August 15, 2015, to aid students with financial constraints and to improve the literacy rates in the country. The scheme is a completely IT-based student financial aid authority to administers and monitors scholarship and educational loan schemes.

The Vidya Lakshmi Education loan official portal has also been launched to provide access to students about various private and public banks and organisations that offer education loans their eligibility criteria and document requirements all in one portal. Indian Bank, State Bank of India, HDFC Bank, Canara Bank, etc offer education loans to both male and female students based on various eligibility criteria under the Vidya Lakshmi education loan scheme.

Vidya Lakshmi Education Loan Scheme

Vidya Lakshmi education loan scheme helps students procure loans as soon as possible and bridges the gap between the required amount of funds to complete the course. The Vidya Lakshmi education loan is offered under 139 schemes by 37 registered banks for students to choose from and the loan can be easily applied in just three steps through common education loan form.

The Vidya Lakshmi Education Portal is one of its kind, and it was set up by various government bodies such as the Department of Financial Services (Ministry of Finance), Department of Higher Education (Ministry of Human Resource Development), and Indian Banks Association (IBA).

Vidya Lakshmi Education loan portal was developed by NSDL e-Governance Infrastructure Limited (NSDL e-Gov), and they are also responsible for maintaining this portal. With the help of the scheme, students are enabled to easily apply for a loan and they can track their loans at any point since this portal is linked to many National Scholarship Schemes.

Vidya Lakshmi Educational Scheme Contact:

- Vidya Lakshmi education loan helpline number: 020-2567 8300

- Vidya Lakshmi education loan mail id: vidyalakshmi@proteantech.in

- Working Hours: Monday to Friday - 9:30 am to 6 pm

- Location : Times Tower, 1st Floor, Kamala Mills Compound, Lower Parel, Mumbai, Maharashtra 400013

Also Read: Prodigy Finance Education Loan and Scholarship

Vidya Lakshmi Education Loan Interest Rate

The Vidya Lakshmi education loan interest rate starts from 8.40%. However, they can avail of education loans up to INR 4 Lakh without any collateral for a tenure of up to 15 years.

Interest rates for Vidya Lakshmi education loans vary from banks, and it also depends on the loan scheme. The loan aims to encourage the students to complete their higher education despite having a financial deficit.

The Vidya Lakshmi education loan details and interest rates for male and female students in popular banks are,

For Male Students:

- Up to INR 7.5 Lakhs - 12.75% p.a. as on 01.01.2017

- Above INR 7.5 Lakhs - 11.50% p.a. as on 01.01.2017

For Female Students:

- Up to INR 7.5 Lakhs - 12.25% p.a. as on 01.01.2017

- Above INR 7.5 Lakhs - 11% p.a. as on 01.01.2017

Note: The interest rate varies on each bank eligible for providing the loan.

Security

Co-obligation of parents and no security is required for loans up to INR 7.50 Lakhs and for loans above INR 7.50 Lakhs, co-obligation of parents and collateral security of suitable value accepted by the bank.

Repayment and Moratorium Period

The repayment period will only start after 1 year of course completion or 6 months after securing a job.

Also Read: Top 5 Banks Offering Education Loan Without Collateral

Features of Vidya Lakshmi Education Loan

The Vidya Lakshmi Education Loan scheme's main objective is to provide eligible students with an easy and effective system of accessing education loans to attain a quality education. Students will be able to get information about the different schemes offered by various bank and their details in the official portal.

Listed below are the Vidya Lakshmi Education Loan features:

- Information about the different schemes and education loans offered by various public and private banks

- The details regarding the loan application form and the application process

- The students will be able to apply for more than one bank at a time for educational loan

- The portal also provides the facility to download the loan application form for future references

- The loan process and its details can be viewed in the Vidya Lakshmi portal using the student's login credential

- Grievances can directly be addressed to the respective bank using the contact details provided on the website.

Also Read: Canara Bank Education Loan

Vidya Lakshmi Education Loan Eligibility

Vidya Lakshmi Education Loan is offered for courses in categories such as graduation, and post-graduation including regular technical and professional degree or diploma courses conducted by colleges or universities approved by UGC, AICTE, IMC, Government, etc.

Other eligible courses are as follows.

- Regular degree or diploma courses conducted by autonomous institutions like IIT, IIM, etc.

- Teacher training or nursing courses approved by the Central Government or the State Government.

- Regular degree or diploma courses like aeronautical, pilot training, shipping, etc., approved by the Director-General of Civil Aviation/Shipping

The course eligibility for abroad studies is as follows.

- Job-oriented professional, post-graduation degree, technical graduation degree courses, and diploma courses like MCA, MBA, MS, etc., offered by reputed universities.

- Courses conducted by CIMA (Chartered Institute of Management Accountants), CPA (Certified Public Accountant) in the USA, and similar courses.

Also Read: Indian Bank Education Loan

Student Eligibility Criteria of Vidya Lakshmi Education Loan

The Vidya Lakshmi education loan eligibility criteria require the students to fulfil certain requirements such as citizenship, merit score, family income, etc. However, the eligibility criteria vary as per the bank and scheme. Listed below is the student eligibility criteria to avail of the Vidya Lakshmi education loan:

- The applicant must be an Indian citizen to be eligible for the education loan

- The students should have already secured admission to either professional or technical courses through an entrance test/selection process conducted by the respective university.

- Going for abroad studies, the students should have compulsorily secured admission to a university or an institute abroad when they apply for Vidya Lakshmi educational loan.

- There are no minimum qualifying marks stipulated in the last qualifying examination to apply in the Vidya Lakshmi portal.

Also Read: Bank of Baroda Education Loan

How to Apply for an Education Loan?

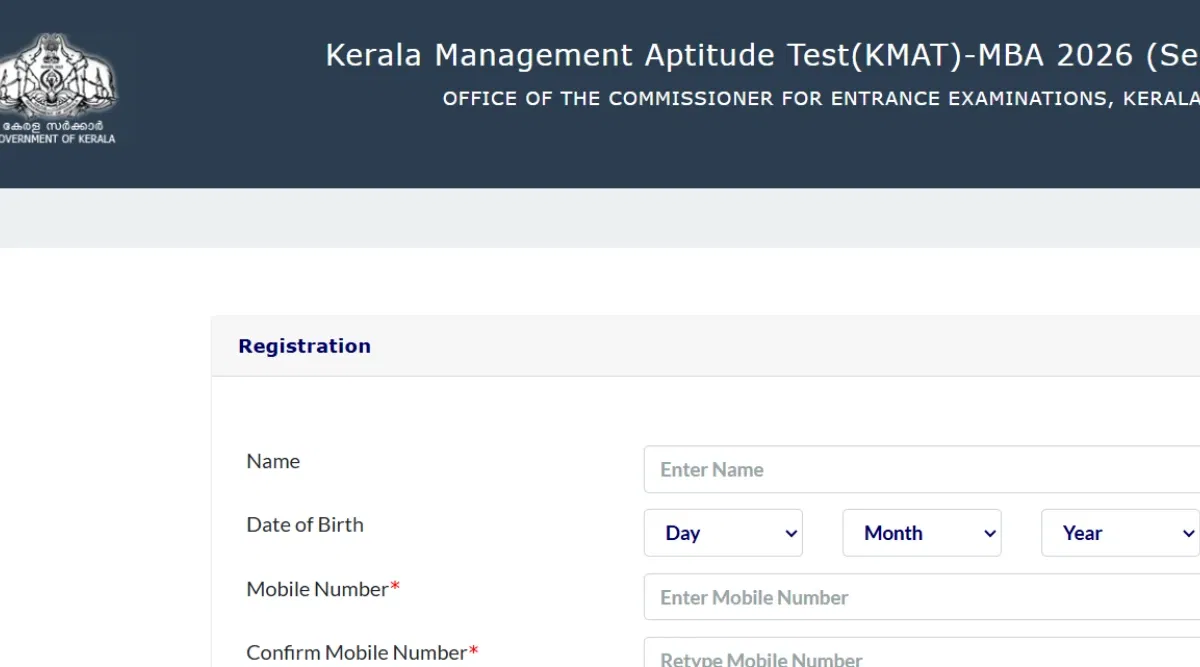

Students must register themselves on the Vidya Lakshmi education portal to apply for the loan. The procedure applies to all the banks registered under the Vidya Lakshmi education loan scheme.

Srudents can follow the instructions and procedures mentioned below to register and apply for a Vidya Lakshmi education loan.

- The student should register themselves at the Vidya Lakshmi portal, i.e., www.vidyalakshmi.co. to log in.

- The students should fill out the Vidya Lakshmi common education loan application form with all the necessary details mentioned in the form and upload the documents required for the Vidya Lakshmi education loan to get the student login.

- After filling out the Vidya Lakshmi portal education loan form, the student can search for educational loans and apply for them according to their needs, convenience, and eligibility in the Vidya Lakshmi portal.

- The Common Educational Loan application is the single student form that needs to be filled out to apply for Educational Loan to multiple banks/schemes.

- CELAF is the form prescribed by the IBA, the Indian Banks Association and accepted by all banks. The online form is provided on the Vidya Lakshmi education portal to apply for a loan.

- The students can view their Vidya Lakshmi loan status and processes through the applicant's dashboard on the portal.

- The amount of money applied will be disbursed by the bank directly outside the portal.

Also Read: SBI Education Loan

List of Banks Registered with Vidya Lakshmi Education Loan

There are 37 banks registered with the Vidya Lakshmi Education Loan Scheme, and there are currently 139 loan schemes offered.

The following banks are registered with the Vidya Lakshmi Education Loan Scheme.

| Abhyudaya Co-Operative Bank | Karnataka Bank | Central Bank of India |

| Allahabad Bank | New-India Co-operative Bank | Canara Bank |

| Andhra Bank | Corporation Bank | DNS Bank |

| Bank of Baroda | RBL Bank | Federal Bank |

| Dena Bank | Tamilnad Mercantile Bank Ltd. | Indian Bank |

| HDFC Bank | United Bank of India | Indian Overseas Bank [IOB] |

| IDBI Bank | Vijaya Bank | UCO Bank |

| State Bank of India [SBI] | ICICI Bank | Pragathi Krishna Grameen Bank |

| Karur Vysya Bank [KVB] | Kotak Mahindra Bank | Axis Bank |

| Bank of Maharashtra | Oriental Bank of Commerce | Kerala Gramin Bank |

| Punjab National Bank [PNB] | Union Bank | Andhra Pragathi Grameena Bank |

| Punjab and Sindh Bank [PSB] | Bank of India [BOI] | J & K Bank |

| - | Syndicate Bank | - |

Also Read: Education Loan For MBA in India 2024

Benefits of the Vidya Lakshmi Education Loan Scheme

Through the Vidya Lakshmi portal, students can view, apply and track the education loan applications in a single place. Below are the benefits of the Vidya Lakshmi Educational Portal.

- All the information related to education loans is provided in one place, i.e., the Vidya Lakshmi portal.

- It gives a simple way to apply for education at different banks through a single student form.

- It also provides a link to the National Scholarship Portal to view and apply for government scholarships.

- It allows students to contact the respective bank for their queries and complaints.

- Banks can also download the student loan application form.

- Banks can also upload the status of loan processing.

- It provides the direct transfer of loan amount to the associated bank account of the student without getting in touch with Agents.

- This portal provides faster processing of loan amounts without any hidden charges.

POST YOUR COMMENT