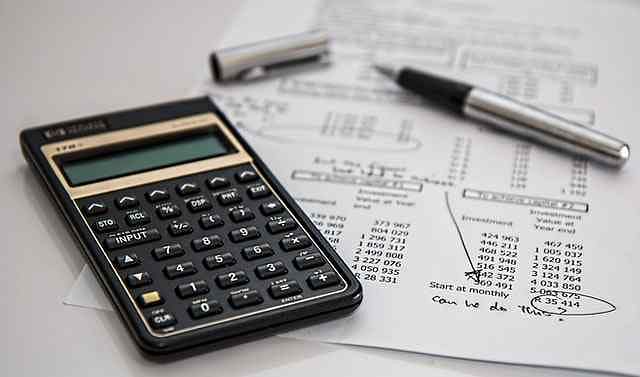

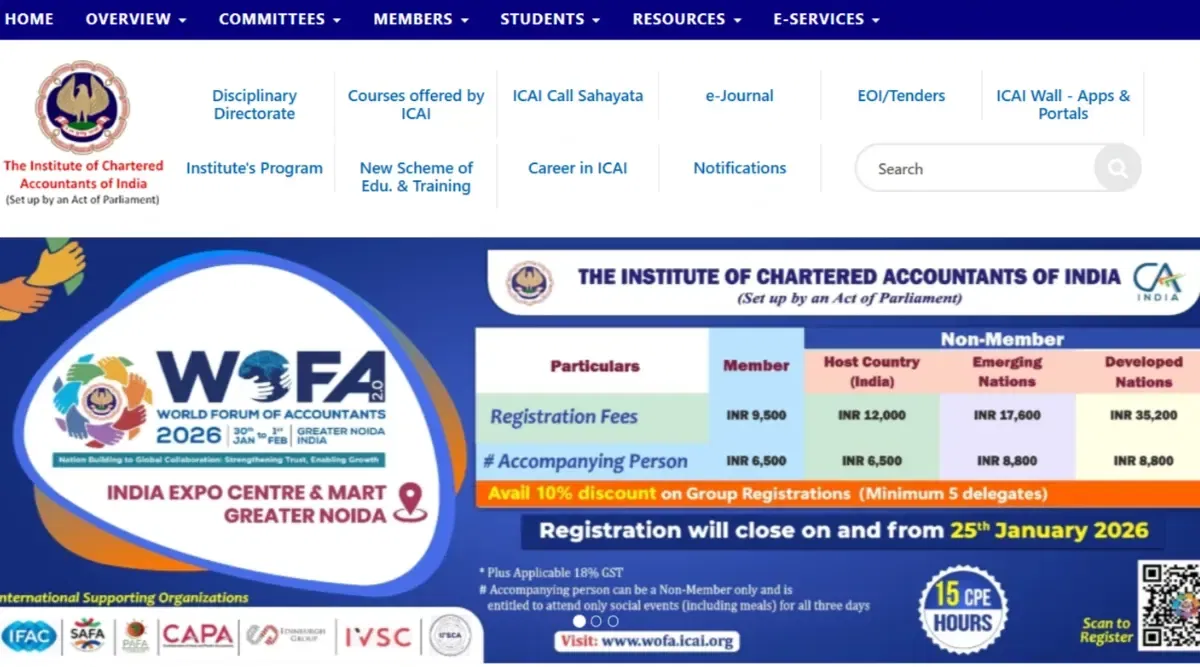

ICAI CMA June 2023 Inter and Final results have been released. The ICAI full form is the Institute of Chartered Accountants in India. ICAI organises various exams and acts as a regulatory body to all Chartered Accountancy institutes in India.

Table of Contents

ICAI full form is the Institute of Chartered Accountants in India. It was established on Jul 1, 1949, as an institute that acts as a regulatory body to all Chartered Accountancy institutes in the country. The conducting body organises three levels of exams for students to recruit them for CA positions. ICAI is considered to be the second-largest accounting and finance organisation in the world. ICMAI CMA 2023 Inter and Final exam results are out now.

Important notice on exemptions from appearing in CA Intermediate and Final May 2024 exams was released on Aug 24, 2023. ICAI CA November 2023 exams have been rescheduled due to assembly elections in Chattisgarh and Madhya Pradesh.

ICAI Full Form

The Institute of Chartered Accountants in India (ICAI) is the governing body that gives out the accounting standards on which the accounts of any company are to be calculated. These accounting standards are based on the Companies' Act 2013. Before that year, the accounting standards were based on the Companies Act 1913.

Here's the three levels of exams candidates need to qualify to attain CA:

- CA Foundation Exam or Common Proficiency Test (CPT)

- Intermediate-Level Examination or IPCC

- CA Final Examination

ICAI 2023 Highlights

The ICAI CA course is not like the conventional 3-year course. Instead, anyone who wishes to become a CA must pass 3 levels of exams conducted twice a year by the ICAI.

Some of the highlights of the exam are mentioned in the table below.

| Particulars | Details |

| Exam Name | ICAI |

| ICAI Full Form | Institute of Chartered Accountants of India (ICAI) |

| Exam Level | National |

| Exam Category | Undergraduate (UG) |

| Course Offered | CA Foundation Exam or Common Proficiency Test (CPT)Intermediate-Level Examination or IPCC CA Final Examination |

| Exam Mode | Offline, as a Pen and Paper-based Test |

| Language | English |

| Frequency | Twice a year |

| Official Website | icai.org |

ICAI 2023 Exam Eligibility

Each exam has its eligibility criteria to be met if one wants to clear everything. However, the one common criteria they do share is that they must not fail even a single subject. If failed in even one subject, the candidate must apply for a re-attempt for all subjects, including those they passed.

Let's take a look at the eligibility criteria for each ICAI exam.

CA Foundation Exam

To appear for the CA foundation exam, candidates must have a class 12 board exam certificate with any specialisation from a recognised board or university. In addition, they must have passed all subjects in it.

Here is the list of eligibility criteria for the CA Foundational Exam.

- One must have registered on the Board of Studies.

- One must have changed to the CA Foundation Course with the Board of Studies of ICAI on or before the exam year.

- One must obtain a minimum score of 15 in all the sections and have 100 marks as an aggregate to pass the exam.

- If one fails to score 15 in even a single section, even if obtained 100 marks in total, then it will be considered a failure.

CA Intermediate Exam

The intermediate exam has bigger criteria to meet when compared to the Foundation exam.

Let's take a look:

- One must have already completed the Foundation exam to appear for this one.

- One must clear both Groups I and Group II to write the IPCC exam.

- One must write near-perfect answers since they will be verified by the topmost faculty at ICAI.

- One must obtain at least 50% in every subject and 50% as an aggregate score for each group.

- If the total does not cross 50%, the candidate will be rejected even if they passed all the subjects.

CA Final Examination

To appear for CA Final examination, one must have already completed both the Foundation Exam and the Intermediate Exam to be considered for this one.

Other eligibility requirements are as follows.

- One must have a certificate of apprenticeship from any organisation or any recognised chartered accountant that claims a period of 2.5 years.

- One must have the training required for CA Final Examinations. This is normally received during the last half-year period of your apprenticeship.

ICAI 2023 Exam Pattern

ICAI CA exam is divided into three levels. Each of the exams is conducted separately. The CA foundation course carries 400 marks. Whereas the sectional division in Intermediate and Final are more. These carry 800 marks each.

ICAI CA Foundation Exam Pattern

| Papers | Marks |

| Principles and Practice of Accounting | 100 marks |

|

Section A: Business Laws Section B: Business Correspondence and Reporting |

Section A - 60 marks Section B - 40 marks |

|

Part A: Business Mathematics Part B: Logical Reasoning Part C: Statistics |

Part A - 40 marks Part B - 20 marks Part C - 40 marks |

|

Part A: Business Economics Part B: Business and Commercial Knowledge |

Part A - 60 marks Part B - 40 marks |

| Total Marks | 400 |

ICAI CA Intermediate Exam Pattern

| Papers | Marks |

| Group 1 | |

| Paper 1: Accounting | 100 marks |

|

Paper 2: Corporate and Other Laws Part I: Company Law Part II: Other Laws |

Part I: 60 marks Part II: 40 marks |

| Paper 3: Cost and Management Accounting | 100 marks |

| Paper 4: Taxation Section A: Income Tax LawSection B: Indirect Taxes |

Section A: 60 marks Section B: 40 marks |

| Total | 400 |

| Group 2 | |

| Paper 5: Advanced Accounting | 100 marks |

| Paper 6: Auditing and Assurance | 100 marks |

|

Paper 7: Enterprise Information Systems and & Strategic Management Section A: Enterprise Information Systems Section B: Strategic Management |

Section A: 50 marks Section B: 50 marks |

| Paper 8: Financial Management & Economics for Finance | 100 marks |

| Total | 400 |

ICAI CA Final Exam Pattern

| Papers | Marks |

| Group 1 | |

| Paper - 1: Financial Reporting | 100 |

| Paper-2: Strategic Financial Management | 100 |

| Paper - 3: Advanced Auditing and Professional Ethics | 100 |

| Paper - 4: Corporate and Economic Laws | 100 |

| Total Marks | 400 |

| Group 2 | |

| Paper - 5: Strategic Cost Management and Performance Evaluation | 100 |

|

Paper - 6A: Risk Management Paper - 6B: Financial Services and Capital Markets Paper - 6C: International Taxation Paper - 6D: Economic Laws Paper - 6E: Global Financial Reporting Standards Paper - 6F: Multidisciplinary Case Study |

100 |

| Paper - 7: Direct Tax Laws and International Taxation | 100 |

| Paper - 8: Indirect Tax Laws | 100 |

| Total Marks | 400 |

ICAI 2023 Exam Syllabus

Candidates are filtered based on the results obtained from those 3 exams. On the one hand, it's easy to crack the CPT exam because the paper follows an objective-type MCQ model. On the other hand, the final two are set with a descriptive format, and irrelevant information provided to their questions will not be considered towards your aggregate score.

Therefore, the syllabus PDFs are attached in the table below for the candidate’s benefit.

| Courses | PDFs |

| ICAI CA Foundation | Download Now |

| ICAI CA Intermediate | Download Now |

| ICAI CA Final | Download Now |

POST YOUR COMMENT