Bihar Board 12th Accountancy Syllabus 2025: Check Unit-Wise Topics and Marking Scheme

The Bihar Board 12th Accountancy Syllabus 2025 can be availed online at the official website of the Bihar Board. The syllabus consists of two parts: Part A contains 4 chapters, and Part B includes 3. Students can refer to the syllabus and focus on topics such as Accounting for partnership firms, Dissolution of partnership firms, Debenture capital and more. Candidates must know the Bihar Board 12th Exam Pattern 2025 to have clarity of the marks allocation.

The paper will be graded for 100 marks, of which students must score a minimum mark of 30 percent. Moreover, students who fail to achieve the passing marks can sit for the BSEB 12th compartment exam 2025. Furthermore, the board will conduct the BSEB 12th exam 2025 for Accountancy in February 2025 (tentative) in pen and paper mode.

Table of Contents

- Bihar Board 12th Accountancy Syllabus 2025: Download PDF

- BSEB 12th Accountancy Syllabus 2025: Chapter-Wise Details

- BSEB 12th Accountancy Syllabus 2025: Marks Distribution

- Prescribed Books for Class 12 Accountancy Syllabus Bihar Board 2025

Bihar Board 12th Accountancy Syllabus 2025: Download PDF

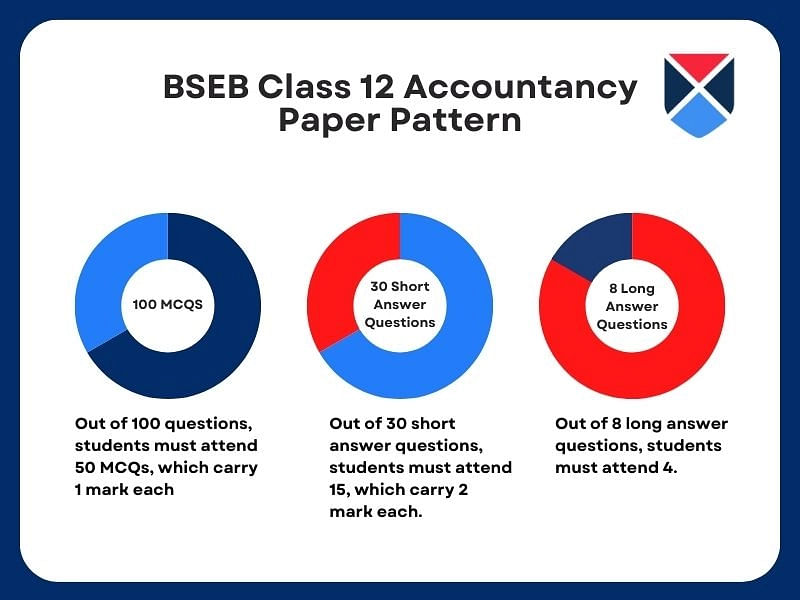

Section A contains 100 MCQ-type questions, which will carry 1 mark each, and students must answer 50 questions. Similarly, section B will have 30 short answer type questions, which will take two marks each, and students must attempt 15 questions. Download the Bihar Board 12th Accountancy Syllabus 2024-25 PDF mentioned below to learn more.

| Particulars | PDF Link |

| Bihar Board 12th Accountancy Syllabus | Download Now |

Refer to the image below to understand the Accountancy paper in more detail.

Also Check: Bihar Board 12th Previous Year Question Papers

BSEB 12th Accountancy Syllabus 2025: Chapter-Wise Details

Students must use the detailed 12th Accountancy syllabus Bihar board to strategize their preparation plan. Moreover, students are also advised to use the BSEB 12th exam pattern to understand the marking scheme and paper pattern.

- Bihar Board 12th Accountancy Syllabus 2025: Part A - A/C for Non-Profit Organisation & Partnership

- Bihar Board 12th Accountancy Syllabus 2025: Part B - Company Accounts and Financial Statement Analysis

Bihar Board 12th Accountancy Syllabus 2025: Part A - A/C for Non-Profit Organisation & Partnership

Given below are the detailed class 12 Accountancy syllabus Bihar board which students can refer to.

1. Accounting for Partnership (साझेदारी लेखांकन)

- Definitions and terms related to Partnership

- The Indian Partnership Act 1932

- Methods of capital accounts

2. Accounting for Not-for-Profit Organizations (अलाभकारी संस्थाओं के लिए लेखांकन)

- Introduction, meaning, and characteristics and important terms related to Not for Profit Firms.

- Receipts and Payments Accounts

- The distinction between Expenditure and Income account.

- Preparation of Income and Expenditure Account and Balance Sheet.

Important Items: Entrance fees, Subscriptions, Sale of old assets, Scrap, Newspapers, Specific donation, Legacy, life membership fees, General Donations, Specific Funds, Endowment fund.

Additional Information: Outstanding expenses and prepaid expenses of the current and previous year -Accrued income and income received in advance -Subscription received in advance and Subscription outstanding of the current and previous year -Depreciation -The capitalization of entrance fees. -Creation of special funds out of donations -Stock of stationery -Opening balances of liabilities and assets

3. Dissolution of Partnership (साझेदारी फर्म का विघटन)

- Simple dissolution

- Dissolution under insolvency situation

4. Reconstitution of Partnership (साझेदारी फर्म का पुनर्गठन)

- Meaning and different ways of reconstitution of Partnership

- Admission of a partner.

Bihar Board 12th Accountancy Syllabus 2025: Part B - Company Accounts and Financial Statement Analysis

Listed below are the detailed Bihar board 12th Accountancy syllabus for 2025 for the student's reference.

1. Accounting for Shares and Debenture Capital (अंशपूँजी और ऋणपत्रों के लिए लेखांकन)

I. Accounting for Shares

- Share and share capital, Meaning, Features, and Types.

- Accounting for Share Capital

- Accounting treatment of re-issue and forfeiture

- Disclosure of Share capital in the Company's Balance Sheet (Horizontal format).

II. Accounting for Debentures

- Debentures: Meaning, Issue of debentures at par, at a premium, and at a discount- differences

- Issuance of debentures for consideration other than cash

- Interest related to Debentures

3. Analysis of Financial Statements (वित्तीय विवरणों का विश्लेषण)

- Financial Statement Analysis

- Tools for financial statement Analysis

- Accounting Ratios

4. Statement of Changes in Financial Position (वित्तीय स्थिति में विवरणों के परिवर्तन)

I. Introduction and the importance of preparation of Final Accounts in relation to the following adjustments:

- Closing stock

- Prepaid expenses

- Outstanding expenses

- Income received in advance

- Income receivable

- Reserve for possibility of discounts on debtors and creditors

- Bad debts

- Provision for doubtful debts

- Depreciation

- Interest on capital, loans, and drawings -Interests earned/given on investments and loans

- Goods destroyed by accident or fire (insured / uninsured)

- Record of goods stolen

- Goods used free sampling purpose

- Goods withdrawn by partners

- Unregistered Sales and Purchases

- Capital expenditure included in revenue expenses and vice-versa

- Bills payable dishonoured

- Bills receivable dishonoured

- Deferred expenses

- Capital receipts included in revenue receipts and vice-versa

- Commissions to working partner/ Managers on the basis of gross profit, net profit, sales, etc.

BSEB 12th Accountancy Syllabus 2025: Marks Distribution

Students must refer to the chapter-wise marks distribution for Bihar board 12th Accountancy syllabus 2024-25 to enhance their preparation skills. Moreover, students must familiarize themselves with the Bihar class 12th sample paper to thoroughly understand the paper pattern.

| Chapter No. | Name of Chapter | Marks |

|---|---|---|

| 1. | Accounting for Partnership (साझेदारी लेखांकन) | 05 |

| 2. | Accounting for Not-for-Profit Organizations (अलाभकारी संस्थाओं के लिए लेखांकन) | 10 |

| 3. | Dissolution of Partnership (साझेदारी फर्म का विघटन) | 25 |

| 4. | Reconstitution of Partnership (साझेदारी फर्म का पुनर्गठन) | 20 |

| 5. | Accounting for Shares and Debenture Capital (अंशपूँजी और ऋणपत्रों के लिए लेखांकन) | 12 |

| 6. | Analysis of Financial Statements (वित्तीय विवरणों का विश्लेषण) | 08 |

| 7. | Statement of Changes in Financial Position (वित्तीय स्थिति में विवरणों के परिवर्तन) | 20 |

Also Read: Bihar Board 12th Scrutiny Online Form 2025

Prescribed Books for Class 12 Accountancy Syllabus Bihar Board 2025

Students must use the BSEB 12th Accountancy books to understand the chapters in detail. Moreover, students must read the textbook thoroughly and highlight important definitions, terms, and differences. Refer to the table below for more details.

| Books | Publications |

| Financial Accounting -I | NCERT Publication |

| Accountancy -II | NCERT Publication |

| Accountancy -I | NCERT Publication |

| Accountancy -II | NCERT Publication |

| Accountancy – Computerised Accounting System | NCERT Publication |

Also Check for All Subjects: Bihar Board 12th Books 2025